21st Century Fox Rescinds Buyout Offer for Time Warner

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth while minimizing risk.

It only costs $25 to join us for a one-week trial, to see whether Goodfellow LLC can help increase your capital gains!

* * * * *

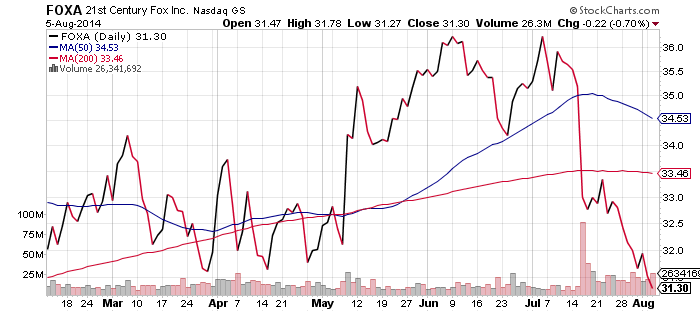

21st Century Fox Inc. (FOXA) has withdrawn its takeover offer for Time Warner Inc. (TWX). Time Warner rejected the offer three weeks ago. Since that time, FOXA shares have fallen approximately 11% in value.

On the heels of rescinding the takeover offer, 21st Century Fox announced an authorization to repurchase $6 billion of FOXA Class A shares. The share buyback program should shore up the price of the stock, appeasing shareholders, and possibly attracting new investors.

I wrote about this merger offer on July 16th under the title Time Warner Spurns 21st Century Fox Merger Offer. There were two versions of the article that day: one for subscribers, and one less detailed for website visitors. (Obviously, I save my more valuable insights for the investors who pay an annual fee to read my daily articles.)

I correctly told investors exactly what to do with TWX and FOXA shares, including the following assessments and instructions:

-

As is typical during buyout activity, shares of the purchasing company, FOXA, have fallen to recent price support around $33.50/$34 on today’s news. The next support level is around $31.50.

-

Buyouts are expensive — expect [FOXA] to stagnate as long as this potential purchase remains on its horizon. Cautious shareholders are encouraged to use a stop-loss around $33, in case the shares fall further.

-

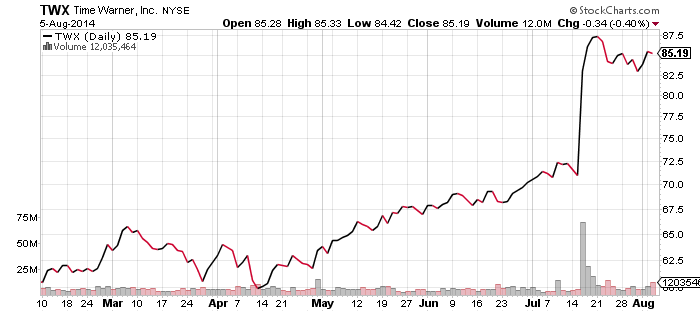

Cautious shareholders are encouraged to use stop-loss orders [on TWX] to protect today’s profits from eroding, in the case that no purchase is agreed to in the coming weeks.

All of that advice was spot-on, and none of it required guesswork on my part. If you would like to start receiving better stock investing recommendations, featuring both fundamental and technical analysis, please subscribe now to Goodfellow LLC.

How to Proceed with FOXA and TWX Shares

FOXA shares are tremendously overvalued. Earnings per share are expected to grow 12.5% and 11.8% in 2014 & ’15. Those are decent growth rates. But the 2014 & ’15 price/earnings ratios (PE) are staggering in comparison, at 20.5 and 18.3. Nothing could compel me to buy shares in 21st Century Fox.

On the flip side, there’s no reason to hurry and sell FOXA shares, either. With the stock sitting at firm support levels, and a share repurchase plan in place, the stock price is unlikely to fall further.

If I owned FOXA shares, my plan would be to sell them after a small rebound to $32.50. I would then reinvest my money into an undervalued growth stock with a bullish chart.

Goodfellow LLC Rating on FOXA: Sell at $32.50, Public. (08/05/14)

Scroll past FOXA chart for further discussion of TWX.

Chart courtesy of StockCharts.com.

Time Warner shares are likely to drop, now that the buyout offer has officially been rescinded. The stock price could conceivably fall back down to $72. I certainly hope that investors took my advice and used stop-loss orders to protect their profits.

TWX is not currently on my buy list, because EPS growth is projected to be quite slow this year, at 6.1%. I would therefore not buy the stock at any price in the near future.

Chart courtesy of StockCharts.com.

* * * * *

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply