The Art of Buying Stocks During Volatile Markets

We’re in a new phase in the stock market this year: stocks are correcting, and your investment skills are being tested.

We’re in a new phase in the stock market this year: stocks are correcting, and your investment skills are being tested.

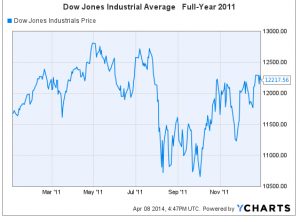

We had a year like this in 2011 (see chart on right). The Dow Jones Industrial Average went up 5.5% that year, but the ride was nerve-wracking. Traders did well. Buy-and-hold investors probably jumped ship when the market fell in March, or June, or August-September-October, or at Thanksgiving.

The point is that successful stock market investors have strategies in place for deciding which stocks to buy, at what prices. Let’s focus on buying low.

Given a volatile market, here are the two types of stocks I would buy:

1. Buy high quality, undervalued stocks during small price corrections.

Most investors have more good stocks on their radars than they can own at any one point in time. During market corrections, take some of your cash and buy one of those stocks which has fallen to its support level. We’re not looking for stocks in a freefall; we’re just looking for stocks which have repeatedly bounced at the same price during recent months, then rebounded.

Invesco Ltd. (IVZ, $35.10) is a good example. The company is projected to grow its earnings per share (EPS) 14-16% per year for the next three years; the price-earnings ratio (PE) is 14.4; and the dividend yield is 2.6%.

Invesco Ltd. (IVZ, $35.10) is a good example. The company is projected to grow its earnings per share (EPS) 14-16% per year for the next three years; the price-earnings ratio (PE) is 14.4; and the dividend yield is 2.6%.

The stock has been trading with the market, bouncing at support around $34.25 five times since early December.

2. Buy high quality, undervalued stocks during upside price breakouts.

When you can find stocks which are seemingly unaffected by market downturns, those are likely to be the first to go up when the market rebounds.

When you can find stocks which are seemingly unaffected by market downturns, those are likely to be the first to go up when the market rebounds.

The energy sector is loaded with these types of stocks right now. Take Schlumberger Ltd. (SLB, $98.09) for example. Wall Street expects EPS to grow 19% in each of the next two years. The PE is 17.3 and the dividend yield is 1.6%

The stock recently broke past three-year resistance. Nobody has missed their opportunity to own SLB shares and to be well-positioned for capital gains. There could be no more perfect chart pattern!

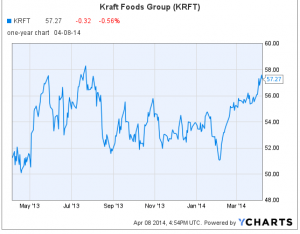

Kraft Foods Group (KRFT, $57.27) also has a bullish chart pattern. I wouldn’t recommend KRFT on my website, because this year’s strong earnings growth is projected to slow down rapidly in 2015 & 16. However, I mention KRFT here to reinforce that this is the type of chart you want to focus on, especially if volatility makes you queasy.

Kraft Foods Group (KRFT, $57.27) also has a bullish chart pattern. I wouldn’t recommend KRFT on my website, because this year’s strong earnings growth is projected to slow down rapidly in 2015 & 16. However, I mention KRFT here to reinforce that this is the type of chart you want to focus on, especially if volatility makes you queasy.

Did you notice that I didn’t say “buy stocks in poor companies with a lack of earnings growth, high debt levels, and plummeting charts”? Seriously, think about this for a minute. Let’s say that your son is a star high school football player with an excellent GPA. Do you look for a third-rate college for him? No! You look for the best college that will accept him, so as to maximize his football prospects, his career prospects, and his scholarship awards.

Stock investing works the same way. A stock in a company with a strong balance sheet is going to go up sooner than a stock in a company with net losses. A stock with a bullish chart is going to go up faster than a stock with a bearish chart. Your money is, metaphorically, your football-playing son. Give your money the best opportunity to deliver capital gains by concentrating your stock picks on financially-sound companies with bullish stock charts.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply