Citigroup Capital Plan Rejected: How to Proceed with the Stock

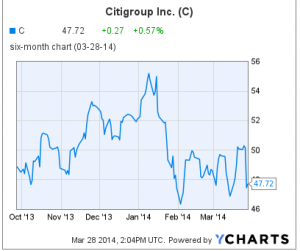

(C, $47.72, up $0.27)

Wall Street was stunned yesterday when the Federal Reserve denied Citigroup Inc.’s (C) capital plan, during the second leg of reporting of the Fed’s recent stress test results. Citi had planned to repurchase $6.4 billion of stock, and to increase its dividend by five cent per share. Citi will continue with its current aim to repurchase a previously-authorized $1.2 billion of stock through first quarter 2015.

The Fed blamed the rejection on the complexity of Citi’s multinational operations, and cited a recent $400 million fraud within Citi’s Mexican operations.

Citigroup immediately announced a redeployment of capital towards repurchasing $2 billion of trust preferred securities, due April 28, 2014.

View My Stock Portfolio Results

Morgan Stanley commented yesterday, “A capital diamond currently in the rough, we believe today will be a good buying opportunity for Citi investors.”

Earnings per share (EPS) growth projections have slowed at Citigroup, since my January 6 report, to 10%, 19%, and 9% in 2014 through 2016. The PE is very fair at 9.9; and the dividend yield is tiny at 0.08%.

On March 20 I wrote, “The slower EPS numbers are not high enough to keep a buy rating at Goodfellow LLC. As such, I’m removing Citigroup from my buy list. The stock is not overvalued, and could easily rebound to recent highs of $55.”

On March 20 I wrote, “The slower EPS numbers are not high enough to keep a buy rating at Goodfellow LLC. As such, I’m removing Citigroup from my buy list. The stock is not overvalued, and could easily rebound to recent highs of $55.”

The stock is likely to continue trading between $47-$51 in the short-term.

The numbers are still attractive enough for it to rebound towards $55. The problem is that investors who want bank stocks have smooth sailing as they choose other financial institutions with good earnings and good dividends. In comparison, there’s no logical reason to choose Citi’s stock, which has been hamstrung by the Fed, and therefore contains more risk, and fewer reasons to rise.

If I owned the stock, I’d trade out at $50.40 and reinvest my capital into a stock with strong earnings growth and a bullish chart. Subscribe now to read my weekly feature, Monday’s “Buy List”, for excellent current investment ideas.

A one-week trial subscription to Goodfellow LLC only costs $25!

I would not short this stock — the trading support level is strong, and does not appear to be in jeopardy.

There will, of course, be traders who want to “buy low” to catch the price rebound, but I would recommend confining short-term trades to stocks with bullish fundamentals. “Trading” doesn’t have to mean throwing all caution to the wind.

Goodfellow LLC subscribers are kept apprised of trading and investing opportunities in stocks which meet our fundamental and technical investment criteria, thereby limiting risk as much as is reasonably possible.

Investors who want to “buy low” for a longer term hold are, again, encouraged to invest in stocks with strong fundamentals & charts, to maximize their chances of making money sooner rather than later.

Goodfellow LLC Rating: Sell (at $50.40), Volatile, Public. (03/28/14)

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply