Featured Stocks in Action — week of July 29, 2013 (August 2nd update)

Posted by Crista Huff on Aug 2, 2013 in Buy Now!, Dividend Stocks, Famous Stocks, Free Stock Market Content, Growth Stocks | 0 comments

(Note: This article was reserved for Goodfellow LLC subscribers until January 28, 2017, when I made it available to the general public.)

Google Introduces Moto X, New Smartphone Competitor

Google Inc.’s (GOOG, $906.57) wholly-owned Motorola Mobility unit is rolling out its new flagship Moto X smartphone this summer, with prices starting at $199, in direct competition to the iPhone and Galaxy S. The new phone will be made in America, and features competitive improvements in design, camera, battery life and usability.

Google’s earnings are projected to grow 9, 18, and 18 percent over the next three years. The PE is 20.8.

Google’s earnings are projected to grow 9, 18, and 18 percent over the next three years. The PE is 20.8.

We told Ransom Notes Radio listeners to buy Google shares below $775 on April 19. The stock is up 17% so far, and still on an uptrend, currently trading between $880 and $928. Investors may have one more opportunity to buy below $900 before the stock starts reaching new highs again.

Goodfellow LLC Rating: Buy, Growth. Read our research report. (08/02/13)

Goodfellow LLC Rating: Buy, Growth. Read our research report. (08/02/13)

* * * * *

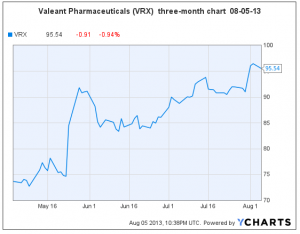

Valeant Pharmaceuticals (VRX, $96.45) just broke out of another trading range yesterday. Scroll down to see our July 29 commentary.

Goodfellow LLC Rating: Buy, Aggressive Growth. (08/02/13)

* * * * *

Prudential Financial Inc. (PRU, $82.62) is approaching resistance at $85, at which time it could easily bounce down into the upper $60’s. We discontinued our buy rating on Prudential a short while ago because projected earnings growth in ’14 & ’15 had slowed down to the single digits. Current shareholders should be prepared for the stock to establish a new trading range. Goodfellow LLC Rating: Public. (08/01/13)

* * * * *

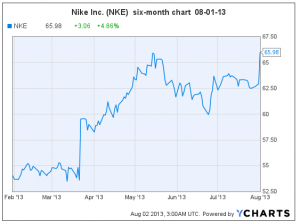

Nike Inc. (NKE, $65.97) is pushing up against resistance at $66. It’s a few days early to tell whether the stock will break out, or trade in the mid-$60’s for a short while.

Nike Inc. (NKE, $65.97) is pushing up against resistance at $66. It’s a few days early to tell whether the stock will break out, or trade in the mid-$60’s for a short while.

Earnings are projected to grow 12%, 15% and 15% over the next three years. The PE is 21.8 and the dividend yield is 1.27%. Investors should read our recent report on Nike and be prepared to jump in if a breakout presents itself. Goodfellow LLC Rating: Buy, Growth, Growth & Income. (08/01/13)

* * * * *

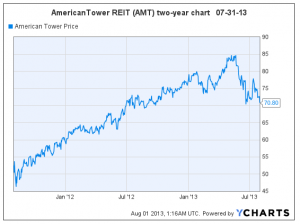

American Tower REIT (AMT, $70.79) reported second quarter numbers, with revenue up 15.7% year-over-year (YOY). The company raised its guidance for full year earnings by $5-$10 million. Citi Research commented, “The company’s results showed nice durability of performance…”

American Tower REIT (AMT, $70.79) reported second quarter numbers, with revenue up 15.7% year-over-year (YOY). The company raised its guidance for full year earnings by $5-$10 million. Citi Research commented, “The company’s results showed nice durability of performance…”

Standard & Poor’s Research commented, “We reduce our target price by $1 to $93, based on the average of our ’14 and ’15 free cash flow estimates. We reduce our ’13 EPS estimate $0.32 to $1.70, ’14’s by $0.04 to $2.74 and ’15’s by $0.08 to $3.20. AMT reported Q2 EPS of $0.25, vs. $0.12, $0.24 below our estimate due to higher than expect forex costs. Adjusted funds from operations of $0.92 per share was above our $0.60 estimate. Revenue was 0.8% ahead and EBITDA was 0.3% above our estimate. We expect strong continued leasing demand due to LTE buildouts and for AMT to benefit from VoLTE and cell site densification.”

The chart shows volatile price swings, and it’ll be a few days before we see whether the stock holds support. The trading range is huge, and if the price holds support, traders should jump in to catch a lucrative price rebound. Read our July report on AMT. Goodfellow LLC Rating: Trading Buy, Accumulate, Aggressive Growth, Growth & Income, Volatile. (07/31/13)

* * * * *

Invesco Ltd. (IVZ, $32.19) reported quarterly profit up 32% year-over-year, a fraction below Street estimates. Management fees, net inflow, and operating costs were all up this quarter.

Invesco Ltd. (IVZ, $32.19) reported quarterly profit up 32% year-over-year, a fraction below Street estimates. Management fees, net inflow, and operating costs were all up this quarter.

Earnings per share are expected to rise 23%, 13% and 11% over the next three years, a good increase since our March report. The dividend yield is 2.80% and the PE is 15.3.

Invesco stock is up 30% plus dividends since we began recommending it in Nov. 2012. It will likely trade between $32 – $35 in the near-term. We would definitely jump in and purchase shares immediately. Goodfellow LLC Rating: Strong Buy, Growth & Income, Value. (07/31/13)

* * * * *

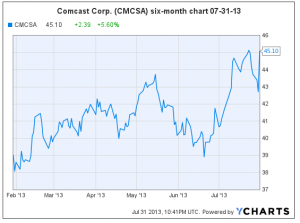

Comcast Reports Great Second Quarter

Comcast Corp. (CMCSA, $45.08) reported an outstanding second quarter, surpassing Wall Street estimates on revenue, earnings, cash flow, and new subscribers. The successes spanned both its cable TV, voice and internet services; and its wholly-owned NBC Universal unit. In addition, Comcast is launching the X1 Platform entertainment operating system from Xfinity in Michigan, representing an innovative TV entertainment experience.

Comcast Corp. (CMCSA, $45.08) reported an outstanding second quarter, surpassing Wall Street estimates on revenue, earnings, cash flow, and new subscribers. The successes spanned both its cable TV, voice and internet services; and its wholly-owned NBC Universal unit. In addition, Comcast is launching the X1 Platform entertainment operating system from Xfinity in Michigan, representing an innovative TV entertainment experience.

Wall Street expects Comcast’s earnings to grow 24, 16, and 18% over the next three years. The PE is 19 and the dividend yield is 1.7%.

On June 10, we told Ransom Notes Radio listeners to buy Comcast shares. The stock has risen 10% since then. We absolutely believe that there’s much more upside to Comcast stock. Goodfellow LLC Rating: Strong Buy, Aggressive Growth, Growth & Income, Value. (07/31/13)

* * * * *

Alexion Prepping for Possible Roche Takeover Offer

Alexion Pharmaceuticals (ALXN, $116.19) has hired Goldman Sachs Group as an adviser, in preparation for a friendly or hostile takeover offer from Swiss drugmaker Roche Holding AG. Roche is interested in adding Alexion’s successful drugs and pipeline to enable corporate growth. However, Citi Research says, “We do not expect Alexion to be acquired.”

Wall Street expects Alexion to increase earnings per share another 42% in 2013. The PE is 38.

Wall Street expects Alexion to increase earnings per share another 42% in 2013. The PE is 38.

In February, we told Ransom Notes Radio listeners to buy Alexion under $90. The stock is up 29% since then, and is breaking out of another trading range this week. The chart is bullish, but there’s downside risk if a buyout doesn’t materialize. Aggressive growth investors should use stop-loss orders. Goodfellow LLC Rating: Strong Buy, Aggressive Growth (07/31/13)

* * * * *

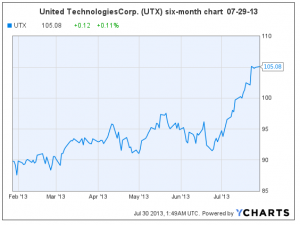

We last wrote about United Technologies Corp. (UTX, $105.07) on June 15 at $94.02. The stock is up 11.8% since that day, and still climbing, although it’s probably about to peak and consolidate for a while. Goodfellow LLC Rating: Hold, Growth, Growth & Income. (07/29/13)

We last wrote about United Technologies Corp. (UTX, $105.07) on June 15 at $94.02. The stock is up 11.8% since that day, and still climbing, although it’s probably about to peak and consolidate for a while. Goodfellow LLC Rating: Hold, Growth, Growth & Income. (07/29/13)

* * * * *

Celgene Corp. (CELG, $142.66) shares are up another $9.50 since our July 18 report. Earnings growth projections have increased to 19%, 20% and 27% over the next three years, since our March 5 report. Goodfellow LLC Rating: Accumulate, Aggressive Growth. (07/29/13)

Celgene Corp. (CELG, $142.66) shares are up another $9.50 since our July 18 report. Earnings growth projections have increased to 19%, 20% and 27% over the next three years, since our March 5 report. Goodfellow LLC Rating: Accumulate, Aggressive Growth. (07/29/13)

* * * * *

Home improvement retailer Lowe’s Companies, Inc. (LOW, $43.44) shares are breaking out of another trading range. On May 12, we suggested “New investors should try to accumulate shares on a dip to $40.50.” Investors had that opportunity several times in June. Then the stock rebounded, completed its trading range, and is ready to climb again. Goodfellow LLC Rating: Strong Buy, Aggressive Growth, Growth & Income. (07-29-13)

Home improvement retailer Lowe’s Companies, Inc. (LOW, $43.44) shares are breaking out of another trading range. On May 12, we suggested “New investors should try to accumulate shares on a dip to $40.50.” Investors had that opportunity several times in June. Then the stock rebounded, completed its trading range, and is ready to climb again. Goodfellow LLC Rating: Strong Buy, Aggressive Growth, Growth & Income. (07-29-13)

* * * * *

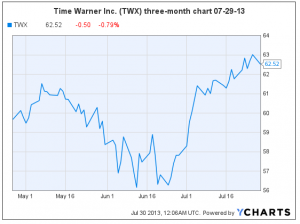

In mid-May, we encouraged investors to accumulate shares of Time Warner Inc. (TWX, $62.50) on a pullback to $55/$56. The stock bounced at $55/$56 in mid-June, completed its trading range, and is now reaching toward new highs. Shareholders who bought at $56 have made 11.6% plus dividends so far. This is an opportune time for investors to buy TWX shares and catch the beginning of the next run-up.

In mid-May, we encouraged investors to accumulate shares of Time Warner Inc. (TWX, $62.50) on a pullback to $55/$56. The stock bounced at $55/$56 in mid-June, completed its trading range, and is now reaching toward new highs. Shareholders who bought at $56 have made 11.6% plus dividends so far. This is an opportune time for investors to buy TWX shares and catch the beginning of the next run-up.

Earnings growth projections remain steady at 12%, 16% and 15% over the next three years. The dividend yield is 1.84% and the PE is 17. Goodfellow LLC Rating: Strong Buy, Growth & Income. (07/29/13)

* * * * *

Valeant Fine-Tuning Corporate Structure in Light of Bausch & Lomb Merger

(VRX, $91.41, down $0.55 midday)

Valeant Pharmaceuticals International Inc. plans to reduce headcount by 10-15%, consolidate some locations and experience quicker-than-expected cost savings as it readies itself for the planned acquisition of contact lens-maker Bausch & Lomb Holdings. Valeant is a rapidly growing Canadian drugmaker, in the areas of dermatology, neurology and ophthalmology.

Valeant has projected earnings growth of 24%, 44% and 19% over the next three years, a PE of 15.6, and high debt levels.

Valeant has projected earnings growth of 24%, 44% and 19% over the next three years, a PE of 15.6, and high debt levels.

On April 29, we recommended that Ransom Notes Radio listeners buy Valeant stock. The shares have since risen 21%. The stock appears to be ready to break out of a trading range in the near-term. This is a good time to buy shares in Valeant Pharmaceuticals. Goodfellow LLC Rating: Buy, Aggressive Growth. See our latest report on VRX from July 6. (07/29/13)

* * * * *

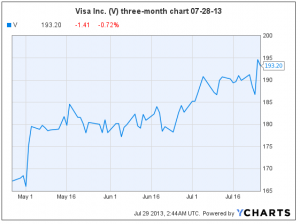

We last reported on Visa Inc. (V, $193.20) on July 1 when the stock broke out of a trading range. The stock broke out again on July 25. Earnings per share (EPS) growth projections have increased to 22%, 17% and 18% over the next three years. We would continue to buy shares of Visa on dips to $191, and especially if it bounced down to $187. Goodfellow LLC Rating: Strong Buy, Aggressive Growth. (07-28-13)

We last reported on Visa Inc. (V, $193.20) on July 1 when the stock broke out of a trading range. The stock broke out again on July 25. Earnings per share (EPS) growth projections have increased to 22%, 17% and 18% over the next three years. We would continue to buy shares of Visa on dips to $191, and especially if it bounced down to $187. Goodfellow LLC Rating: Strong Buy, Aggressive Growth. (07-28-13)

* * * * *

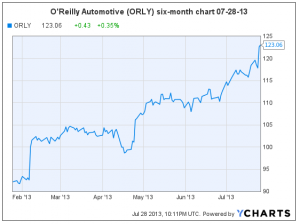

O’Reilly Automotive (ORLY, $123.06) continues to rise since our last report on July 6. Earnings per share growth estimates have recently increased to 24% in 2013. The stock is up 21% since our first recommendation on February 25, and has been reaching new highs all year. We would not chase the stock at this price, but would consider buying on a bounce to $118. Goodfellow LLC Rating: Hold, Growth. (07/28/13)

* * * * *

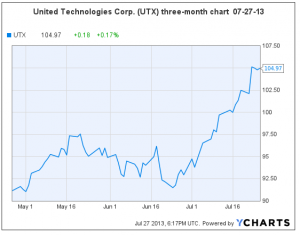

On June 15, we encouraged investors to “buy low” on United Technologies Corp. (UTX, $104.97) as it finished a “double-bottom” chart pattern. It then immediately had a “shakeout” chart pattern, and took off to new highs. The stock is up 11.6% since June 15, and 13.1% since we began recommending it on March 26.

On June 15, we encouraged investors to “buy low” on United Technologies Corp. (UTX, $104.97) as it finished a “double-bottom” chart pattern. It then immediately had a “shakeout” chart pattern, and took off to new highs. The stock is up 11.6% since June 15, and 13.1% since we began recommending it on March 26.

Earnings per share (EPS) are expected to grow 15%, 13% and 12% over the next three years. The price-earnings ratio (PE) is 17.1 and the dividend yield is 2.04%. The long-term debt ratio is 43%.

We would delay additional purchases until the stock consolidates for a while. Goodfellow LLC Rating: Growth & Income, Growth, Hold (07/27/13)

* * * * *

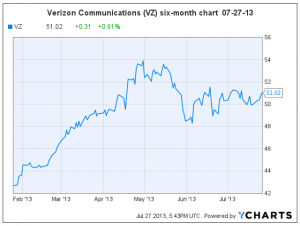

Verizon Communications Inc. ($51.02) — This stock has a steady pattern of rising, consolidating, rising, consolidating. We’re well into the current consolidation phase: this would be a good time for investors to buy shares of VZ. The stock is trading between $49.50 — $54.50. Investors can reasonably expect to be able to buy below $51 for at least a couple more days.

Earnings per share (EPS) are projected to grow 21%, 15%, 10% over the next three years. The dividend yield is 4.04%, and the price earnings ratio (PE) is 18.2. Our one caveat on Verizon is that the long-term debt ratio is high at 59%.

Earnings per share (EPS) are projected to grow 21%, 15%, 10% over the next three years. The dividend yield is 4.04%, and the price earnings ratio (PE) is 18.2. Our one caveat on Verizon is that the long-term debt ratio is high at 59%.

Here’s our latest news article on Verizon, and our last research report. Goodfellow LLC Rating: Buy, Growth, Growth & Income (07/27/13)

* * * * *

eBay Inc. (EBAY, $52.25) has been in a trading range since late November. Now is a perfect time for traders and growth stock investors to buy shares and catch the next rebound.

eBay Inc. (EBAY, $52.25) has been in a trading range since late November. Now is a perfect time for traders and growth stock investors to buy shares and catch the next rebound.

On July 18 we wrote, “We’ve been recommending eBay stock for two years, and the price is up a tremendous amount. It’s currently consolidating in a range of $49.50 to $58 as it bumps up against long-term resistance at $59. We would absolutely accumulate shares under $53. Read our most recent research report.” Goodfellow LLC Rating: Trading Buy, Growth (07/27/13)

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply