GM Issues New Recalls Relating to Axles and Transmission Lines

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth while minimizing risk.

It only costs $25 to join us for a one-week trial, to see whether Goodfellow LLC can help increase your capital gains!

* * * * *

General Motors Co. (GM, $34.73) announced late yesterday that it is recalling 672,200 cars, trucks, and SUVs to fix problems which can lead to axle fractures and transmission cooler line issues. This recall comes on the heels of a recent recall and Congressional investigation into ignition switch problems which allegedly caused crashes, and led to 12 deaths.

In a conversation with an Ohio GM dealer on March 25, Morgan Stanley analyst Adam Jonas gleaned these insights on local auto sales:

-

March sales are up about 40% year-over-year (YOY);

-

inventory is a little low, especially on Equinox and Malibu;

-

the ignition recall is not hurting sales, but it’s keeping the service departments busy;

-

the new Tahoe is awesome, and the Impala “needs some help”;

-

and used car sales are suffering due to quality issues.

Standard & Poor’s (S&P) expects GM’s revenues to climb 3.7% in 2014. Large 2013 European losses are expected to taper in 2014. Wall Street expects GM’s earnings per share (EPS) to grow 17%, 31% and 15% in 2014 through 2016 (Dec. year-end).

The 2014 price-earnings ratio (PE) is very low at 9.52%, within a 2010-2013 range of 4-18; and the 2013 long-term debt ratio is 12%.

On January 13 I reported, “President Dan Ammann said yesterday that the company is getting closer to reinitiating a quarterly dividend payout.” The next day, the company announced its first quarterly dividend in over six years. The current dividend yield is hefty at 3.46%.

When I wrote about GM on January 13, I listed the reasons that I wouldn’t own the stock. Those reasons had to do with intricate government involvement in GM’s operations, and the company’s irresponsible treatment of shareholders and employees.

S&P gives GM shares a Risk Assessment of Medium. “Our risk assessment reflects the highly cyclical and increasingly competitive nature of GM’s markets, offset by our view of the company’s leaner post-bankruptcy cost structure and lower debt obligations.”

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

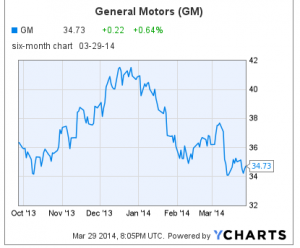

On February 3 I wrote, “If I owned GM shares, I would hold them for an expected near-term rebound to about $38.50, then reassess at that time.” The stock proceeded to rise to $38.05 in early March, then fell again.

The stock broke through medium-term upside resistance in May 2013 (scroll down to see the three-year chart).

The stock has good support at $33.50/$34.00 where it bounced repeatedly last summer, and again this month. The chart is bearish, however, the stock could bounce up to $37.50/$38.00 in the very short term. But with the additional recall issues announced on March 28, I’m wondering how much more bad news the stock can take, before breaking support.

The stock has good support at $33.50/$34.00 where it bounced repeatedly last summer, and again this month. The chart is bearish, however, the stock could bounce up to $37.50/$38.00 in the very short term. But with the additional recall issues announced on March 28, I’m wondering how much more bad news the stock can take, before breaking support.

I’m very glad I don’t own GM stock. If I owned it, and it held support on Monday morning, I would expect a near-term rebound and put in a sell limit order at $37.25. If the stock closes below support on Monday, it’s a short candidate.

There’s no reason for investors to go bottom-fishing with GM. There are many other stocks available with strong earnings growth and more bullish charts, which should theoretically achieve capital appreciation more quickly than shares in General Motors Company.

Goodfellow LLC Rating: Aggressive Growth, Growth & Income, Volatile, Value, Public. (03-29-14)

Subscribe now to get better stock ideas from

Goodfellow LLC

screened for strong earnings growth and bullish charts!

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply