The Second Leg of the Market Correction is Unfolding

In early December, the S&P 500 fell 5.1% from its recent high to its recent low, in the course of eleven days. The market rout was spurred on by plunging oil prices. On December 18th, in an article titled Hold Your Horses, I warned investors that the market was not going to quickly, permanently recover from the December market downturn, saying “While it’s conceivable that stocks could fully rebound in the short-term, I have a strong sense that the markets need to bounce at their recent lows at least one more time before they recover.”

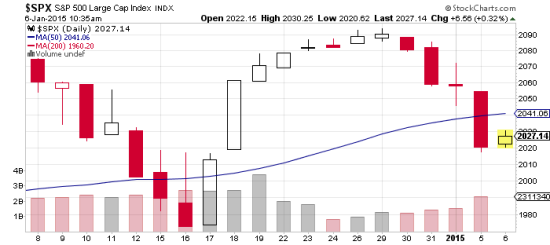

Typically, a big down day for the S&P 500 is followed by one or two days wherein the market closes relatively flat, followed by another big drop. Look at the candlestick chart, below. The pattern from this week is a clone of the pattern from Dec. 10-11. At that time, the market subsequently fell another 60 points, or 2.95%, before rapidly turning around.

Watch for a repeat of this pattern. If you’d like to buy low when the S&P drops below 1980, please subscribe now, then look at my model portfolios for 2015, on the home page. They feature undervalued growth stocks with bullish charts.

Sign up to receive the free weekly Goodfellow LLC stock-investing newsletter,

and I’ll send you my Insider’s Report on IPO’s!

Chart courtesy of StockCharts.com.

* * * * *

Please send questions and comments to research@goodfellowllc.com.

Crista Huff

President

Goodfellow LLC

* * * * *

Eight of the ten 2012-2014 Goodfellow LLC stock portfolios

outperformed The U.S. stock market indices by 50-100% and more!

Join us!

* * * * *

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth and minimize risk.

Join us for a one-week trial, and let Goodfellow LLC help increase your capital gains!

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply