Preparing to Buy Low: Relax, Breathe, Wait, Shop, Buy

The stock market is going through a normal correction during an uptrend. Corrections like this are healthy and normal, and give us an opportunity to “buy low”.

One of the ways that I know a correction is coming is that several of my stock positions get “stopped out”, a few days in a row. When that happens, I hold onto the cash, watch the market averages, look for stocks with bullish charts (for example, charts similar to the other stocks I own which didn’t get stopped out), and I put in buy orders.

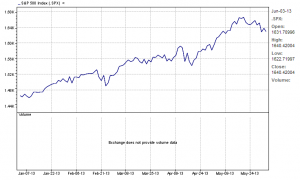

Here’s how the charts look right now:

The Dow Jones Industrial Average is at 14,961. There appear to be support levels at about 14,900 and 14,400. Typically during a correction, a stock or a market average will do a double bounce at support levels, indicating a constructive chart pattern, and signalling a buy opportunity. (Sometimes the market will instead form a bullish cup-and-handle chart pattern.) I’ll be watching for that in the coming days, and alerting investors as to which stocks represent good buying opportunities with healthy chart patterns.

The S&P 500 Index has a similar pattern. The index is currently valued at 1608.90. There appears to be support at about 1600 and 1540.

I believe that we have at least a few days to watch and identify a near-term market bottom. And if the market wants to fall to secondary support, it will easily do that without us jumping in prematurely. When it settles down, I’ll write up a list of which of our favorite buy-recommended stocks look most appealing at that time.

Website visitors may sign up for a one-month free trial subscription, thereby accessing the stock articles and buy recommendations. (One free trial per person is allowed. Then you’ve got to make a decision on whether to subscribe. Frankly, with seven out of seven sample stock portfolios at Goodfellow LLC significantly outperforming the market averages, this decision is a no-brainer. Join us!)

Please send questions to research@goodfellowllc.com.

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply