Revenue Model Transition Paves Way for Immediate Future Growth

Adobe Systems Surpasses Estimates on Cloud Subscribers

Software company Adobe Systems Inc. (ADBE, $45.68) beat quarterly profit expectations on surprising momentum with its new Creative Cloud product. The company is sacrificing short-term revenue and earnings from traditional up-front software purchases, and implementing a monthly subscription model for its popular graphic-design products.

Watch for an immediate rebound on margins, as earnings are expected to climb 19% and 25% in 2014 & ’15.

Standard & Poor’s Research (S&P) gives ADBE shares a Qualitative Risk Assessment of “Medium”. “Our risk assessment reflects the regularly changing nature of the software arena, and our view that the success of new products will depend on the global economic environment. These factors are offset by our view of the company’s size and market leadership, strong operating history, and solid balance sheet.”

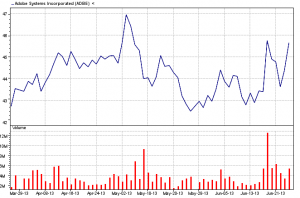

ADBE shares retraced their Nov. 2007 highs in May 2013. The stock

has a bullish chart pattern, trading between $42 and $47 for the last three months. The price will likely remain above $44 now, although we could get one more day where it spikes below $44.

ADBE could appeal to growth stock investors and aggressive growth investors.

* * * * * *

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply