Stocks in the News — week of May 5, 2014 (May 9th update)

News Corp. Surprises Wall Street with Third Quarter Earnings

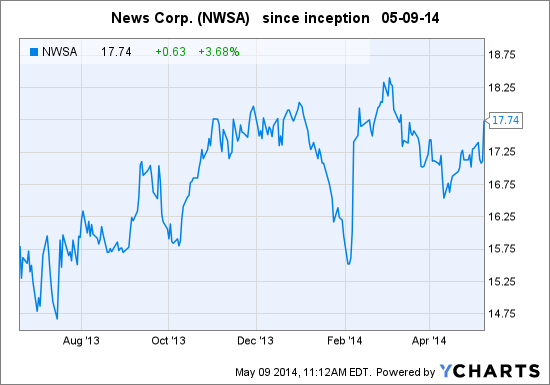

(NWSA, $17.74, up $0.63 midday)

News Corp. reported third quarter adjusted earnings per share (EPS) of $0.11 vs. $0.13 a year ago; much higher than the consensus estimate of $0.03. Revenue fell 5%, hampered by Australia newspaper ad revenue and foreign exchange. Highlights for the quarter includes sales in Digital Real Estate and Harper Collins (book publishing); and strong free cash flow.

Both EPS and revenue came in higher than the market expected, and that’s why the stock is performing well today.

News Corp. (NWSA) separated from Twenty-First Century Fox (FOXA) on June 28, 2013.

News Corps.’ 2014 fiscal year ends in June. Before today’s earnings report, EPS were expected to grow 2% and 16% in 2015 & ’16. However, with today’s strong earnings beat, all of the earnings projections are going to have to be adjusted.

Based on previous estimates, the price-earnings ratio is very high at 40.3. An upside adjustment to earnings expectations will not seriously lower the PE.

NWSA shares do not meet investment criteria at Goodfellow LLC because the earnings growth rate is too low, the PE is too high, and the chart is not bullish. The stock is most likely to trade between $16.80-$18.50 in the near future.

The stock is too overvalued for investors to reasonably expect it to break through upside resistance this year. If I owned the stock, I’d sell it right now, and reinvest my cash in a stock with strong earnings growth and a bullish chart.

Goodfellow LLC Rating: Volatile, Public. (05-09-14)

* * * * *

Priceline Reports Upside First Quarter Earnings Surprise

(PCLN, $1,143.00, up $11.26 in early trading)

Online travel company The Priceline Group Inc. reported first quarter ’14 adjusted earnings this morning of $7.81 — vs. the consensus $6.92 — on a 26% revenue increase. Hotel and car rental bookings led to the upside surprise.

The company guided Wall Street lower on second quarter expectations due to a decline in its “name-your-own-price” business, and advertising expenses which were pushed from the first quarter to the second. But revenue expectations for the same period have been guided upwards.

I reported on PCLN shares yesterday. Subscribe now to read additional comments about The Priceline Group Inc., and my buy/sell/hold recommendation. (05-08-14)

* * * * *

Reiterate Buy on Oilfield Services Stocks

Energy industry stocks continue to lead the market.

Read my most recent review of oilfield services stocks, published at StreetAuthority on April 18.

Subscribe to Goodfellow LLC now for updated coverage on these, and other stocks, with strong earnings growth and bullish charts.

* * * * *

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

* * * * *

Target CEO Resigns Amid Lingering Security Breach Drama

(TGT, $60.23, down $1.78 midday)

Greg Steinhafel will resign as president, chairman, and CEO of Target Corp., in the aftermath of December’s security breach which exposed tens of millions of customers’ personal info to credit card hackers. The company’s technology officer resigned in March.

The current problem haunting the company, in addition to the security breach, is the number of weeks it took Target to aggressively and publicly respond to the problem.

Standard & Poor’s (S&P) commented today, “Although TGT is searching for a permanent replacement, we believe the elevation of the chief financial officer as interim president and CEO, and Mr. Steinhafel’s advising during the transition will allow business continuity. Also, the recent hiring of a Chief Information Officer, with information technology, data security and business operations experience, should aid TGT as it strives to recover customer confidence.”

So how does Target’s stock look right now? Subscribe now to read additional comments about Target Corp., and my buy/sell/hold recommendation. (05-05-14)

* * * * *

Read my weekly feature, Monday’s “Buy List”.

It only costs $25 for a one-week trial subscription to Goodfellow LLC.

All stocks chosen via strict fundamental and technical criteria.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply