Stocks in the News — week of August 19, 2013 (August 23rd update)

Goodfellow LLC’s “Stocks in the News”

seen on Townhall Finance, heard on Ransom Notes Radio

Microsoft CEO to Retire; Company Seeks New Vision

(MSFT, $34.56, up $2.17 midday)

After streamlining the company, but lacking visionary leadership, Microsoft Corp. CEO Steve Ballmer announced today that he will retire within 12 months. The company “has struggled to adapt to the shift away from personal computers and toward mobile devices,” reports Bloomberg. Citi Research says that if the new CEO decides to focus on enterprise, and de-invest from consumer, the stock is worth $42, and could pay a bigger dividend.

Earnings projections have improved since our last report, to 4% growth this year, then 9-10% growth in each of the next two years. The dividend yield is 2.65%, and may increase again in September.

The stock traded sideways during Ballmer’s ten-year tenure as CEO, currently in a range between $31 and $36, with serious resistance at $36.

Goodfellow LLC Rating: Hold, Growth & Income, Value, Public. (08/23/13)

* * * * * *

Aeropostale Shares Plummet as Bad News Snowballs

(ARO, $$8.67, down $2.31 midday)

After reporting second quarter comparable store sales down 15%, Aeropostale Inc. is now expected to take a large net loss for the full year, unexpectedly challenging its cash position, and causing analysts and investors to re-think their investments. Despite attempts to strengthen its apparel mix, sales continue to suffer. Morgan Stanley calls Aeropostale “a structurally challenged business.”

The stock is down 36% since we told Ransom Notes Radio listeners to sell Aeropostale shares on March 15; and it’s hitting ten-year lows today. Investors should put their capital into growth stocks if they want an opportunity for their capital to grow.

Investors who are unable, emotionally, to sell stocks in companies with horrendous finances, like Aeropostale, J.C. Penney, and Sears, need to seriously re-think their investment strategies before they’re ever going to earn money in the stock market. I would tell them to buy mutual funds instead, but these are the same people who sell during market corrections and buy at market tops. Still, they don’t belong in individual stocks.

Goodfellow LLC Rating: Sell, Volatile, Public. (08/23/13)

* * * * *

Investors Overreact to Pandora News: Buy!

(P, $19.10, down $2.61 midday)

Pandora Media Inc. shares fell to support levels today as mixed news shook up Wall Street. The company reported better-than-expected second quarter earnings, with large increases in revenue, market share, number of active users, and listener hours. But it also announced increased expenses, and a plan to cancel its recently-implemented 40-hour-per-month limit on free Mobile listening, shaking Wall Street’s confidence in Pandora’s marketing strategy.

After a string of annual net losses, Pandora is expected to earn a small profit this year, rising rapidly in the next several years.

On July 1, we told aggressive growth investors at Ransom Notes Radio to buy Pandora shares, and to expect volatility. The stock then rose 15% through yesterday and lost all its gains today. Watch for the stock to trade between $19 and $22 in the near-term.

Goodfellow LLC Rating: Trading Buy, Accumulate, Aggressive Growth, Volatile, Public. (08/23/13)

* * * * *

Sears Shareholders are Going Down with the Ship

(SHLD, $39.70, down $3.57 midday)

Shares of Sears Holding Corp. are bouncing at nine-year lows, as bad news continues to surprise investors, driving the share price lower each time. The company announced a large quarterly loss … again. But the magical thinking plays on, as shareholders are apparently determined to go down with the ship.

Second quarter sales were down 6%, including appliance sales, which were strong at competitors Home Depot and Lowe’s. Second quarter losses came in much bigger than expected, with third quarter loss projections increasing. Credit Suisse remarked, “Sears remains on a dangerous downward spiral.”

Sears’ shares are down 21% since the last quarterly report, when we emphatically told Ransom Notes Radio listeners to sell. We reiterate: Shareholders who expect their Sears investments to grow are out of their minds. Sears is not “too big to fail”.

Goodfellow LLC Rating: Sell, Volatile, Public. (08/22/13)

* * * * *

Bank of America Intern Worked to Death

(BAC, $14.56, up 22 cents midday)

A pre-graduate student at the London branch of Bank of America Merrill Lynch has died after working exhaustive hours during his seven-week internship. “He apparently pulled eight all-nighters in two weeks,” another intern said. The company has expressed its condolences to the family.

BofA’s finances are finally emerging from the carnage of the 2008 Financial Meltdown. Earnings per share are expected to grow 268% this year, with continued aggressive growth thereafter. The PE is 16.

The share price is up 13% since we recommended it on July 3. The stock is currently trading between $14 – $15, with a bullish chart. Investors should expect volatility.

Goodfellow LLC Rating: Buy, Aggressive Growth, Volatile, Public. (08/22/13)

* * * * *

Hewlett-Packard Reports Third Quarter on Target; Stock Plummets

(HPQ, $22.31, down $3.07 midday)

Personal computer-maker Hewlett-Packard Co. reported lower year-over-year third quarter results today, largely in-line with expectations, and with surprisingly good numbers on free cash flow. However, the market chose to focus on declining enterprise hardware sales, and the stock fell dramatically.

HP’s full-year earnings guidance remains unchanged, projected to fall 12% this year, followed by two flattish years. The PE is 6.2 and the dividend yield is 2.6%.

The stock is volatile, and likely to trade between $22 and $28 for the rest of the year. With an extremely low valuation, a wide trading range, and the stock at support levels, traders should jump in here.

Goodfellow LLC Rating: Trading Buy, Value, Volatile, Public. (08/22/13)

* * * * *

UPS Asks 15,000 Spouses to Get Health Insurance from Their Own Employers

In direct contrast to government claims that Obamacare will make health insurance more affordable to individuals and employers, United Parcel Service (UPS, $86.09) is planning to drop 15,000 spouses from healthcare coverage in 2014 due to increased costs.

UPS said in a memo to employees that rising medical costs, “combined with the costs associated with the Affordable Care Act, have made it increasingly difficult to continue providing the same level of health care benefits to our employees at an affordable cost.”

Earnings at UPS are projected to grow 5, 15, 12 percent over the next three years. The PE is 18. The long-term debt ratio is high at 62%, and the dividend yield is 2.88%

The stock price broke past long-term resistance this year, and is trading sideways between roughly $85 and $88.

Goodfellow LLC Rating: Public. (08/21/13)

* * * * * *

Staples Shares Fall 30% on Earnings Miss

Office products retailer Staples Inc. (SPLS, $14.27) missed earnings estimates on disappointing second quarter revenues and margins; and increased operating expenses. International revenues were down 8.3% and online revenues rose 3% year-over-year.

Staples revised its full-year outlook downward to reflect a 12% drop in earnings, which assumes additional poor quarters this year.

The stock fell precipitously today, and will likely trade between $14 and $17 for a while. With neither earnings growth nor bullish chart on the horizon, we see no reason for investors to own Staples shares.

Goodfellow LLC Rating: Public. (08/21/13)

* * * * *

Lowe’s Capitalizes on the Housing Recovery

Home-improvement retailer Lowe’s Companies (LOW, $45.81) reported a strong second quarter, with much higher than expected earnings per share and same store sales. The company raised its earnings outlook for the full year, and repurchased $1 billion of stock this quarter, as it also did last quarter.

Lowe’s earnings are expected to grow 20-22% per year for the next three years. The dividend yield is 1.55%; and the PE is 22, in a nine-year range of 11 – 23.

Lowe’s shares are up 14.3% since we reiterated our buy recommendation to Ransom Notes Radio listeners on June 20. The stock has reached new highs all year, most recently trading between $43 and $46. The chart and earnings are strong, but the PE is high. Investors should buy on price dips.

Goodfellow LLC Rating: Accumulate, Aggressive Growth, Growth & Income. (08/21/13)

* * * * *

In direct contrast to government claims that Obamacare will make health insurance more affordable to individuals and employers, United Parcel Service (UPS, $86.09) is planning to drop 15,000 spouses from healthcare coverage in 2014 due to increased costs.

UPS said in a memo to employees that rising medical costs, “combined with the costs associated with the Affordable Care Act, have made it increasingly difficult to continue providing the same level of health care benefits to our employees at an affordable cost.”

Earnings at UPS are projected to grow 5, 15, 12 percent over the next three years. The PE is 18. The long-term debt ratio is high at 62%, and the dividend yield is 2.88%

The stock price broke past long-term resistance this year, and is trading sideways between roughly $85 and $88.

Goodfellow LLC Rating: Public. (08/21/13)

* * * * * *

Staples Shares Fall 30% on Earnings Miss

Office products retailer Staples Inc. (SPLS, $14.27) missed earnings estimates on disappointing second quarter revenues and margins; and increased operating expenses. International revenues were down 8.3% and online revenues rose 3% year-over-year.

Staples revised its full-year outlook downward to reflect a 12% drop in earnings, which assumes additional poor quarters this year.

The stock fell precipitously today, and will likely trade between $14 and $17 for a while. With neither earnings growth nor bullish chart on the horizon, we see no reason for investors to own Staples shares.

Goodfellow LLC Rating: Public. (08/21/13)

* * * * *

Lowe’s Capitalizes on the Housing Recovery

Home-improvement retailer Lowe’s Companies (LOW, $45.81) reported a strong second quarter, with much higher than expected earnings per share and same store sales. The company raised its earnings outlook for the full year, and repurchased $1 billion of stock this quarter, as it also did last quarter.

Lowe’s earnings are expected to grow 20-22% per year for the next three years. The dividend yield is 1.55%; and the PE is 22, in a nine-year range of 11 – 23.

Lowe’s shares are up 14.3% since we reiterated our buy recommendation to Ransom Notes Radio listeners on June 20. The stock has reached new highs all year, most recently trading between $43 and $46. The chart and earnings are strong, but the PE is high. Investors should buy on price dips.

Goodfellow LLC Rating: Accumulate, Aggressive Growth, Growth & Income. (08/21/13)

* * * * *

JPMorgan in Legal Trouble…Again

(JPM, $52.13, up 30 cents midday)

On the heels of arrests in a derivatives scandal, and a new Chinese bribery investigation, JPMorgan Chase & Co. is now under investigation for possible manipulation of energy markets. JPMorgan has already agreed to pay $410 million to end an enforcement action by the Federal Energy Regulatory Commission. Now various energy issues are being examined by the U.S. Attorney in Manhattan, who’s also leading the investigation into the 2012 JPMorgan derivatives scandal.

With slow earnings growth, a neutral technical chart, and three new recent legal problems, we would look elsewhere for attractive stock investments.

Goodfellow LLC Rating: Public. (08-20-13)

* * * *

Interpublic Leads Peers with Progressive Media Efforts

(IPG, $16.08, up 23 cents midday)

Global advertising conglomerate The Interpublic Group of Cos., Inc. “announced one of the most progressive media efforts to date, partnering with key cable, television, radio, and digital properties to expand automated purchasing of media,” reports S&P. “This new consortium brings a more holistic approach to placing advertising across multiple media channels with more targeted placement.”

Interpublic’s earnings growth is subdued this year, but expected to grow 27% next year via margin expansion, and increased sales. Industry consolidation trends also raise merger potential for Interpublic. The PE is 19 and the dividend yield is 1.88%.

The stock is on a steady uptrend, currently trading between $15 and $17.

Goodfellow LLC Rating: Growth, Growth & Income, Public. (08-20-13)

* * * *

Successful Soft Goods Retailer Breaks Away from the Pack

(URBN, $43.88, up $3.96 midday)

Clothing retailer Urban Outfitters Inc. has once again surprised Wall Street with a stronger than expected second quarter. Comparable store sales were up 9%, and eCommerce was up 40%, during a dismal quarter for most soft-goods retailers. The company reported strong gross margin gains, led by expense controls, and reduced Anthropologie brand merchandise markdowns. Morgan Stanley is confident that Urban’s management team can continue growing the company through both domestic retail and international eCommerce.

Wall Street expects earnings to grow 18%, 17% and 13% in the next three years. The company has no long-term debt.

Urban Outfitters stock broke out of a long-term trading range in January, and has been trading between $38 and $45 all year.

Goodfellow LLC Rating: Buy, Growth, Value. (08-20-13)

* * * *

Nestle, Vendor of 8000 Brands, May Re-Think Strategy

After reporting its weakest revenue growth in four years, Swiss food company Nestle S.A. (NSRGY, $66.80) may consider selling some of its underperforming brands, such as Jenny Craig, Lean Cuisine, and Power Bar. Competitors Unilever, Kraft, Sara Lee and Campbell Soup have all recently sold or spun-off business units to maximize shareholder value.

Nestle’s earnings are expected to grow 10 and 7 percent over the next two years. However, potential restructuring charges could erode those numbers.

Nestle’s earnings are expected to grow 10 and 7 percent over the next two years. However, potential restructuring charges could erode those numbers.

The technical chart is neutral. Nestle’s share price is likely to trade between $67 and $70 in the near-term. While there’s nothing essentially wrong with Nestle stock, there’s no compelling reason to own it, either. We would trade out at $70 and invest in a company with stronger projected earnings growth, in order to maximize capital gains.

Goodfellow LLC Rating: Growth & Income, Public. (08/19/13)

* * * * *

JPMorgan Chase Facing More Legal Scrutiny

JPMorgan Chase & Co. (JPM, $51.83) is under suspicion of hiring the children of Chinese officials in order to win banking business. The Securities and Exchange Commission’s anti-bribery unit is conducting a civil investigation into the matter.

This investigation comes on the heels of JPMorgan’s “London Whale” scandal. Arrests were made last week in connection to the credit portfolio loss that caused JPMorgan to overstate first quarter 2012 earnings by several hundred million dollars.

This investigation comes on the heels of JPMorgan’s “London Whale” scandal. Arrests were made last week in connection to the credit portfolio loss that caused JPMorgan to overstate first quarter 2012 earnings by several hundred million dollars.

The company’s earnings growth is slowing to low-to-mid single digits over the next few years, and the technical chart has turned neutral. Despite a low PE and big dividend, we see no reason for investors to own shares of JPMorgan when there are so many growing financial companies with bullish charts to choose from. We would trade out at $55.

Goodfellow LLC Rating: Public. (08/19/13)

* * * * *

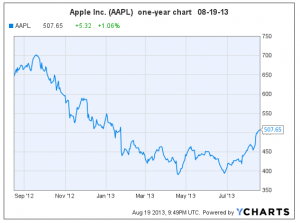

S&P Downgrades Shares of Apple to “Buy”

S&P remains bullish on shares of Apple Inc. (AAPL, $507.74), citing September updates to iPhone and iPad products, and a potential new partnership with China Mobile. Investors were also encouraged last week after learning that billionaire Carl “iCahn” has taken a large position in Apple shares.

On July 2, we said “there’s limited downside at this point”, and we called Apple a trading buy under $420. The stock immediately rebounded, then blew through upside resistance a month later. Shares are up $95 since that day, and traders probably have a little more near-term upside.

On July 2, we said “there’s limited downside at this point”, and we called Apple a trading buy under $420. The stock immediately rebounded, then blew through upside resistance a month later. Shares are up $95 since that day, and traders probably have a little more near-term upside.

We wouldn’t chase Apple stock at this point, because earnings projections continue to slowly decline. Full year profits are expected to fall about 11% this year, then rise 8 and 2 percent in the next two years.

Goodfellow LLC Rating: Value, Volatile, Public. (08/19/13)

* * * * *

(Attention website visitors: You may have access to a free one-month trial subscription, and our newsletter via email, by clicking here. Subscribers receive access to all of the stock articles and stock portfolios on the website.)

Questions? Contact Crista Huff at research@goodfellowllc.com.

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply