Stocks in the News — week of February 24, 2014 (Feb. 28th update)

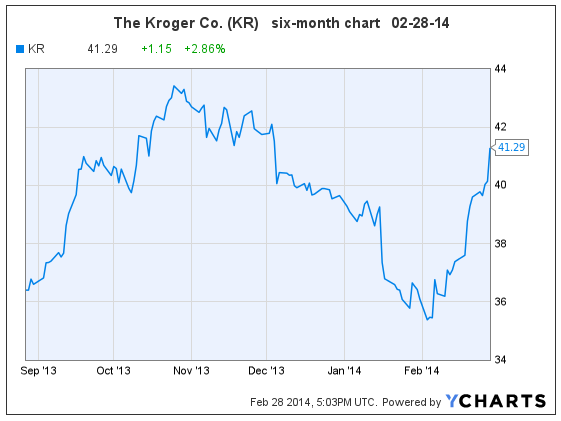

Kroger Shares Up Against Near-Term Price Resistance Today

(KR, $41.29, up $1.15 in early trading)

Shares of The Kroger Co. were up 3% today in early trading.

Earnings per share (EPS) are expected to grow 12% and 10% in 2015 & ’16 (January year-end). The price earnings ratio (PE) is quite fair at 13.2, and the dividend yield is 1.60%.

On January 29, Standard & Poor’s commented, “We believe KR is well positioned to benefit over the intermediate term from an increase in scale and as it significantly increases exposure to higher growth merchandising categories, despite intense pricing competion and increased economic pressure on low income consumers.”

The stock had a 20% correction from the October highs to the February lows. Now that it’s recovering, I expect a near-term pullback, and new trading range of $39.50 – $41.25.

Kroger’s projected earnings growth is not strong enough to earn a buy rating at Goodfellow LLC. If I owned the stock, I’d sell into today’s strength, and reinvest my capital into a stock with stronger earnings growth, and a more bullish chart.

Goodfellow LLC rating: Sell, Public.

* * * * *

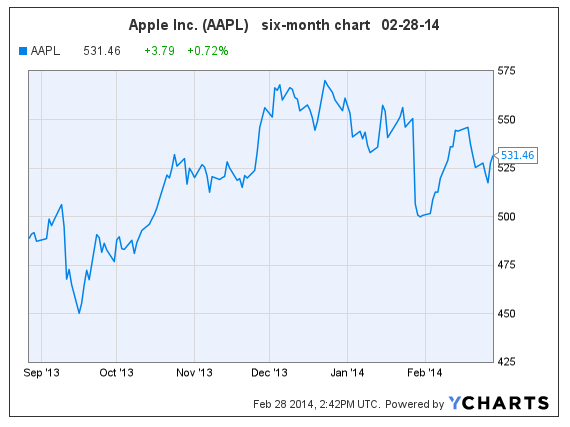

Apple Free From $2.2 Billion Suit…For Now

(AAPL, $531.46, up $3.79 in early trading)

Apple Inc. is currently free from a $2.2 billion patent suit and appeal, brought on by IPCom, over mobile call network technology. A German court dismissed the case today. IPCom plans to appeal again. Read more from Bloomberg.

Apple’s earnings per share (EPS) are expected to grow 8% per year during 2014 through 2016 (September year-end). The price-earnings ratio is (PE) is 12.4, and the dividend yield is 2.3%.

The stock is recovering from a Jan./Feb. correction in the broader market. I expect it to trade between $516-$550 in the short-term; followed by more extensive trading between $530-$570.

Apple’s earnings growth is not strong enough to earn a buy rating from Goodfellow LLC. The stock is fairly valued based on earnings, dividend and PE, and the chart is neutral. I would neither buy nor sell the stock right now. If I owned it, I’d sell around $560, and reinvest my capital in a stock with stronger projected earnings growth and a bullish chart.

Goodfellow LLC rating: Hold, Public. (02-28-14)

* * * * *

Macy’s Thrills Market with Fourth Quarter Results

(M, $56.08, up $3.02 midday)

Famed retailer Macy’s Inc. reported a strong fourth quarter, despite a weak holiday season, and weather-related store closures; including “its fifth consecutive year of double-digit growth in earnings per share [EPS],” says Reuters.

Sales and EPS came in a fraction below consensus estimates. While Wall Street has recently punished stocks on that basis, all caution has been thrown to the wind today, and the market’s on a shopping spree at Macy’s.

Morgan Stanley says, “We believe the market under-appreciates Macy’s continued market share gain potential, as well as the retailer’s best-in-class free cash flow yield and share buyback capacity. Macy’s remains our top department store pick.”

Subscribe now to read more comments on Macy’s, including earnings outlook, chart, and my buy/hold/sell recommendation.

* * * * *

Priceline.com Continues Rising on Bullish Earnings Report

(PCLN, $1351.68, up $38.01 midday)

Shares of online travel company Priceline.com are up another 3% today, on the heels of last week’s strong earnings report, and a rash of increasing price targets on Wall Street.

This past weekend I said, “excitement with the company’s consistent earnings strength and outperformance is going to drive the stock higher.” Subscribe now, and read those comments here.

* * * * *

Home Depot Reports 4Q ’14

(HD, $79.30, up $1.43 at the open)

Home Depot reported fourth quarter 2014 results this morning. Earnings per share (EPS) were $0.73 vs the consensus estimate $0.71. Revenue came in at $17.7 billion vs. the estimate of $17.91 billion. The company increased the quarterly dividend by 21% to $0.47 per share.

On February 4 I said, “The stock will most likely trade between $74-$79 for a while, before resuming its upward climb. I think that investors are relatively safe accumulating shares at $74/$75.” February 4 turned out to be the lowest day in HD’s recent correction.

The chart remains neutral.

Subscribe now to read my additional comments on Home Depot, including fundamental and technical analysis, and my buy/hold/sell recommendation.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply