Stocks in the News — week of July 14, 2014 (July 17th update)

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth while minimizing risk.

It only costs $25 to join us for a one-week trial, to see whether Goodfellow LLC can help increase your capital gains!

* * * * *

Reynolds American to Buy Lorillard in Big Tobacco Merger

Reynolds American Inc. (RAI) plans to purchase Lorillard Inc. (LO, $60.06) in a $27 billion transaction, expected to close in first half 2015.

In order to avoid anti-trust violations, both companies plan to sell assets — including RAI’s blu, its market-leading e-cigarette brand — to Imperial Tobacco Group (ITYBY).

Lorillard shares have fallen significantly since the merger announcement. Yet the share price will invariably gravitate back toward the approximate buyout value of $68.80. With a dividend yield of 4.1%, there’s a great opportunity here for investors to buy LO and earn about 15% profit in less than a year.

I will publish a more extensive review of five major tobacco companies later this week.

(07-17-14)

* * * * *

Time Warner Spurns 21st Century Fox Merger Offer

Time Warner Inc. (TWX) has rejected a buyout offer from 21st Century Fox (FOXA) for an approximately value of $85 per share, consisting of a combination of 1.531 of FOXA shares and $32.42 in cash per each TWX share.

As a result, TWX shares are up about 17% this morning.

In related corporate activity, TWX spun-off Time Inc. (TIME) to shareholders in June 2014; and News Corp. (NWSA) and FOXA separated into two companies in July 2013.

These stocks have appeared in three different Goodfellow LLC stock portfolios in 2013 & ’14, each of which has significantly outperformed the market averages.

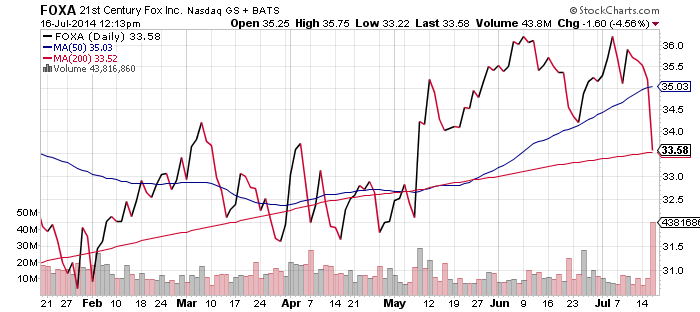

Scroll past FOXA chart for further discussion of TWX.

As is typical during buyout activity, shares of the purchasing company, FOXA, have fallen to recent price support on today’s news.

Buyouts are expensive — expect this stock to stagnate as long as this potential purchase remains on its horizon.

Chart courtesy of StockCharts.com.

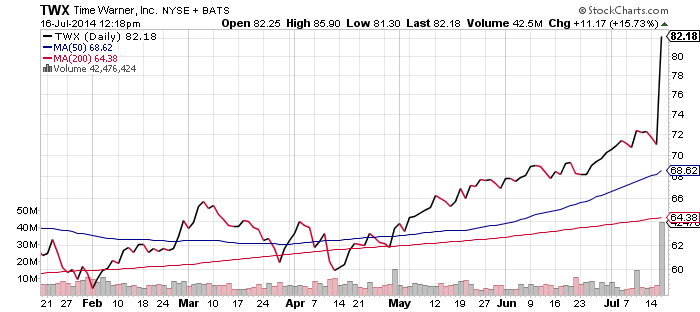

And as is typical of the takeover target, shares of TWX jumped on the news.

To read more of today’s comments, and guidance on how to proceed with shares of FOXA and TWX, please subscribe to Goodfellow LLC today. It only costs $25 for a one-week trial subscription!

Chart courtesy of StockCharts.com.

* * * * *

Citigroup Settles DOJ Litigation; Reports Second Quarter ’14

(C, $48.49, up $1.49 in early trading)

Citigroup Inc. reported second quarter ’14 earnings today, with revenue and expenses 4% and 1% higher than expected, respectively. The market was pleased with the revenue beat, driving the share price higher today. These numbers came in worse than 2Q13, but investors should be reminded that expectations for a down quarter were already built into the stock price. It’s the upside surprise that is driving the stock price today.

Citigroup also announced that it will settle a U.S. Department of Justice (DOJ) investigation into its mortage-backed securities practices by paying $4.5 billion to the DOJ, state Attorneys General, and the FDIC. The company will also provide $2.5 billion in consumer relief. The settlement led to a $3.8 billion charge taken in this year’s second quarter.

JPMorgan Chase & Co. (JPM) settled similar litigation in 2013, and today’s announcement puts pressure on Bank of America Corp. (BAC) to follow suit. Morgan Stanley expects the Bank of America fine to total approximately $12 billion, despite higher press estimates.

In other corporate news, Citi Holdings recently sold its consumer operations in Greece and Spain. The company continues to aggressively work toward reaching acceptable capital and management thresholds, so that it can earn the right to return excess capital to shareholders when the 2015 Fed Stress Test results are posted next March.

2014 earnings per share (EPS) growth projections have been falling all year. The company is now expected to increase EPS 3.6%, 18%, 7% in 2014 through 2016. (These numbers will likely be tweaked following today’s earnings & litigation news.) The price/earnings ratio (PE) is 10.7.

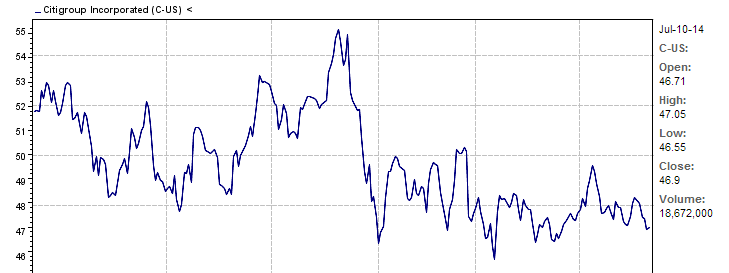

Bargain-hunters, beware: There is NO good reason to buy this stock. EPS projections keep falling, the company has been riddled with bad news this year, and the chart is completely stagnant. I wrote quite a bit about Citi’s problems this year. Please review the link to my April 14th comments, and from there, link to prior news.

For very inexperienced stock investors: It is a mistake to buy a stock that’s mired in problems, when you can buy stock in a healthy, growing company with a bullish chart. Please sign up for a one-week trial subscription, then visit the home page of Goodfellow LLC for my weekly article, Monday’s “Buy List”, for excellent suggestions on stocks which are far more likely to rise immediately.

Goodfellow LLC Rating: Sell, Volatile, Public. (07/14/14)

* * * * *

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

* * * * *

Send questions and comments to research@goodfellowllc.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer Release of Liability:

Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements.

Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply