Stocks in the News — week of March 31, 2014 (April 4th update)

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth while minimizing risk.

Join us for a one-week trial, and let Goodfellow LLC help increase your capital gains!

* * * * *

O’Reilly Automotive: Still Overvalued

(ORLY, $145.37, down $3.16 midday)

I last wrote about O’Reilly Automotive when the stock had a huge price run-up on February 7. At that time, I took the stock off my buy list because the earnings per share (EPS) growth rate was out of whack with the price-earnings ratio (PE).

The projected EPS growth rate has since risen to 16%, 14%, and 12.5% in 2014 through 2016 (December year-end). The 2014 PE has since fallen to 20.7. The numbers continue to indicate an overvalued stock.

The projected EPS growth rate has since risen to 16%, 14%, and 12.5% in 2014 through 2016 (December year-end). The 2014 PE has since fallen to 20.7. The numbers continue to indicate an overvalued stock.

The market is rewarding undervalued stocks this year, and punishing overvalued stocks. In that light, I don’t foresee ORLY shares doing any better than trading sideways for many months to come. My suggestion is to find a good exit point, and then reinvest capital into an undervalued stock with strong earnings growth and a bullish chart.

Goodfellow LLC rating: Hold/Sell, Public. (04-04-14)

* * * * *

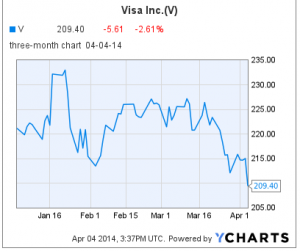

Is Visa’s Chart Falling Apart?

(V, $209.40, down $5.61 midday)

On January 28 I said “I’m discontinuing coverage of Visa Inc. for the time being. Even with the market pullback, Visa’s PE is much higher than its earnings growth rate. Current shareholders should use stop-loss orders to protect profits.”

On January 28 I said “I’m discontinuing coverage of Visa Inc. for the time being. Even with the market pullback, Visa’s PE is much higher than its earnings growth rate. Current shareholders should use stop-loss orders to protect profits.”

The chart is beginning to look ugly. NOBODY should be bottom-fishing within credit card stocks.

(04-04-14)

* * * * *

Hewlett-Packard Shares Continue Climbing

(HPQ, $33.37, up $0.12 midday)

Shares of Hewlett-Packard Co. are still rising, since bottoming in late 2012. There is no particular bullish news on the stock, other than CEO Meg Whitman remarking “that the company would enter the 3-D printing business by the end of the fiscal year,” reports TheStreet.com.

Rather, I believe the bullish chart is driving the stock price higher. There is absolutely nothing attractive enough about the company’s earnings growth expectations to justify any upward move in the stock price.

That being said, I can read a stock chart as well as the next guy, and I’ve been correctly predicting the upward move in the price for many months. I most recently reiterated that stance on March 26 when I said “I think the stock can rise to at least $35 in the near-term before having a pullback.”

Goodfellow LLC Rating: Hold, Value, Volatile, Public. (04-02-14)

* * * * *

Priceline.com Changes Its Corporate Name

(PCLN, $1,240.01, up $48.12 midday)

“Today, priceline.com Incorporated announced that it has changed its name to ‘The Priceline Group Inc .,’ “reports MarketWatch.

Subscribe now to read my most recent comments on PCLN from March 24.

* * * * *

Oracle Stock Breaks Out Again

(ORCL, $40.73, up $1.16 midday)

Shares of enterprise technology company Oracle Corp. have broken through upside resistance, reaching recent highs.

On December 19, in Oracle Shares are Poised to Break Out on the Upside I wrote, “The stock is poised to break through three-year upside resistance. Oracle shares could climb immediately…” The shares are up 11.5% since then, and actively climbing. Shareholders should hold their shares, and expect any bounce at $39/$40 to be normal, with stronger support at $37.50.

ORCL shares do not earn a buy recommendation at Goodfellow LLC due to slow earnings growth. Wall Street expects Oracle’s earnings per share (EPS) to grow 8-9% per year for the next three years (May year-end). The PE is 14.0.

Goodfellow LLC Rating: Hold, Public. (03-31-14)

* * * * *

CBS Corp. (CBS, $62.03) completed the initial public offering (IPO) of its North American Outdoor advertising business on March 28, 2014. The IPO was priced at $28 per share. The new company is named CBS Outdoor Americas Inc. (CBSO, $29.50).

CBSO will subsequently be converted into a Real Estate Investment Trust (REIT).

CBS Corp. retains 83% ownership in the new company. (03-29-14)

Subscribe now to read a more extensive review of CBS & CBSO.

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply