Stocks in the News — Week of November 25, 2013

Hewlett-Packard Reports Fourth Quarter Earnings

Personal computer-maker Hewlett-Packard Co. (HPQ, $25.09) reported fourth quarter earnings after the market closed today. Results pleased Wall Street, with sales of $29.1 billion vs. the expected $27.8 billion, and earnings per share coming in a penny higher than expected. Sales were strong in commercial computers, servers, and networking equipment.

Cash flow numbers, which were surprisingly good in the third quarter, came in 10% higher this quarter. CEO Meg Whitman intends to repurchase shares and increase the dividend in 2014.

HP’s full-year earnings guidance remains unchanged, projected to fall 12% this year, followed by two flattish years. The PE is 7.1 and the dividend yield is 2.3%.

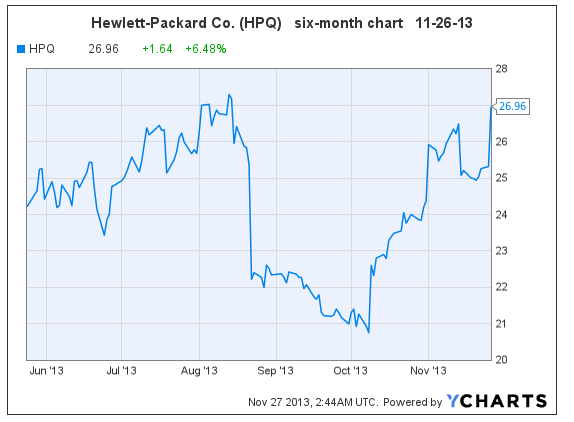

On August 22 I said, “The stock is volatile, and likely to trade between $22 and $28 for the rest of the year. With an extremely low valuation, a wide trading range, and the stock at support levels, traders should jump in here.” The stock price has since risen as much as 19%.

At this point, there’s upside price resistance at $27.50, and then again at $30; with support at $24.75. Traders are likely to continue making money with HPQ. Growth investors should look elsewhere.

Goodfellow LLC Rating: Trading Buy, Value, Volatile, Public. (11/26/13)

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply