Visa: It’s Nowhere Near Where You Want To Be

Goodfellow LLC is a growth stock website. Our subscribers are stock portfolio investors and investment advisors who want better stock ideas, to improve their stock portfolio performance. All of our stock selections are screened via strict fundamental & technical criteria, designed to maximize growth while minimizing risk.

Join us for a one-week trial!

* * * * *

Visa Inc.: Come up with a near-term exit strategy.

(V, $259.80, up $11.80 midday)

Visa Inc., the world’s largest payments network, reported first quarter 2015 earnings yesterday, after the close. Revenues came in 1.3% higher than the market expected. Earnings per share (EPS) came in at $2.53 — four cents higher than expected — due to the slight upside revenue surprise, and lower network and communications expenses.

Investors need to understand that this was a ho-hum earnings report, that Visa’s business segments did not outperform across the board, nor do anything at all to warrant a 5% surge in the stock price. The market has been reacting in a crazy manner to earnings reports this week, creating up-and-down volatility to the likes of which I have never seen during my 27 years of stock investing.

DO NOT use large price swings to gauge a stock’s value or investability! Continue to analyze the real numbers, and make logical decisions.

Wall Street expects Visa’s earnings per share (EPS) to grow 14.4%, 15.8%, and 14.6% in 2015 through ’17 (September year-end). Those are solidly attractive numbers. The problem is that the 2015 price/earnings ratio (PE) is 25.0.

Sign up to receive the free, weekly Goodfellow LLC stock-investing newsletter! —->>>

As a rule-of-thumb, the PE should be lower than the earnings growth rate (with minor adjustments for dividends and industry trends, etc.), in order for the stock to be considered undervalued. And personally, I see no reason to ever purchase a stock that’s overvalued, because overvalued stocks have no capital gain advantage, yet they hold increased risk.

The company also announced a 4-for-1 stock split, payable on February 18. Do not allow the stock split to distract you from the fact that the stock price is wildly overvalued. Stock splits have no bearing on valuation. Please refer to my article, Stock Splits Are a Cosmetic Gimmick to Appease Investors.

Shares of Visa Inc. remain ineligible for a Goodfellow LLC buy recommendation due to the high PE.

My Very Accurate Price History with Visa’s Stock

Visa Inc. was featured in the Goodfellow LLC Model Portfolio for Second Half 2012, which nearly tripled the performance of the S&P 500.

I maintained buy and strong buy ratings on the stock until January 17, 2014. At that time, I said “At this point I would not chase Visa shares, due to the high PE. Rather, I would put in a stop-loss order at $217, be prepared to raise the stop-loss as the stock continues to rise, and be prepared for the stock to sell at the next market downturn.” The stock peaked the very next business day, then proceeded to fall, and trade sideways, for nine months.

I subsequently discontinued coverage of the stock, and will reinitiate coverage if-and-when the stock becomes undervalued again.

Eight of the ten Goodfellow LLC portfolios exceeded

stock market index performances by 50-100% and more.

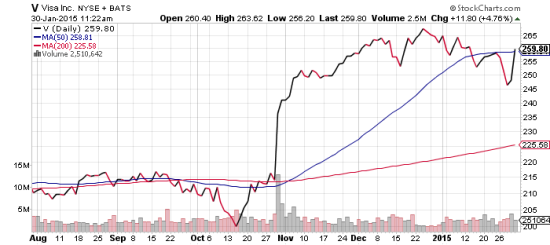

Current shareholders should use a tight stop-loss order to protect their capital. Keep in mind that the chart pattern was distinctly bearish prior to today’s price surge. The share price could easily revert to a bearish chart pattern.

There is a decent chance that today’s enthusiasm could precipitate the stock trading sideways for a while, likely between $250-$270. In that light, I don’t see any particular opportunity for bulls or bears to profit in the short-term.

If I owned the stock, I would put in a stop-loss order at $250, and alternately be prepared to sell on the next bounce upward to approx. $262.

Goodfellow LLC Rating: Come up with a near-term exit strategy, Public. (01/30/15)

Chart courtesy of StockCharts.com.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply