Featured Stocks in Action — week of October 28, 2013 (Oct. 31st update)

Posted by Crista Huff on Oct 31, 2013 in Buy Now!, Dividend Stocks, Famous Stocks, Free Stock Market Content, Growth Stocks | 0 comments

(Note: This article was reserved for Goodfellow LLC subscribers until January 28, 2017, when I made it available to the general public.)

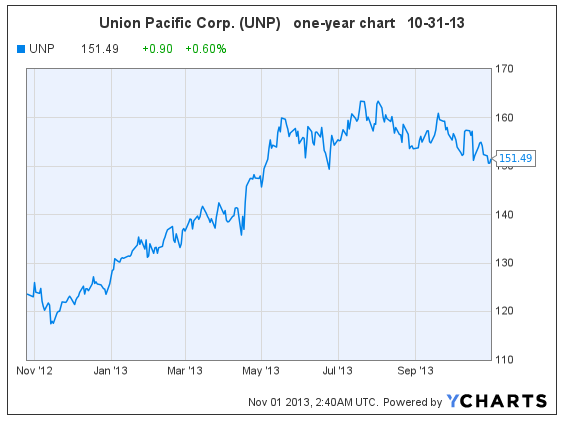

Morgan Stanley commented on Union Pacific Corp. (UNP, $151.40) yesterday, “UNP’s housing product carloads have historically tracked closely with US housing starts. Morgan Stanley economists forecast housing starts to grow ~22% and ~12% in FY14 and FY15, respectively, which should bode well for UNP volume growth given housing represents ~8% of UNP’s overall volumes.”

Consensus earnings growth projections have come down a little from my October 4th report, to 13% 14% and 13% in 2013 through 2015.

The stock is bouncing at six-month support levels around $150, and will likely remain in a trading range for the time being.

Goodfellow LLC rating: Accumulate, Growth, Growth & Income. (10-31-13)

* * * * *

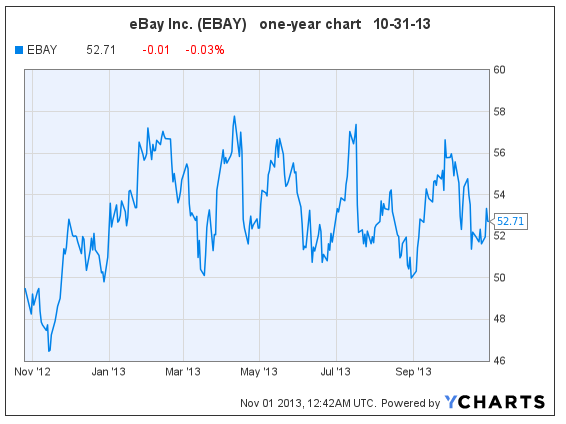

eBay Inc. (EBAY, $52.71) has been in a trading range between $50 – $58 since last November. It’s frustrating, I know, and I can’t actually point to another growth stock that I follow that’s been stuck like this.

eBay’s earnings projections have come down a fraction since my September 26 report, currently expected to grow 14-17% per year for each of the next three years.

The stock is featured in my article Best Stocks Now — October 27, 2013. It would be easy enough to trade the trading range, of course. But investors are waiting for the stock to break through resistance and do something.

Goodfellow LLC Rating: Accumulate, Growth. (10/31/13)

* * * * *

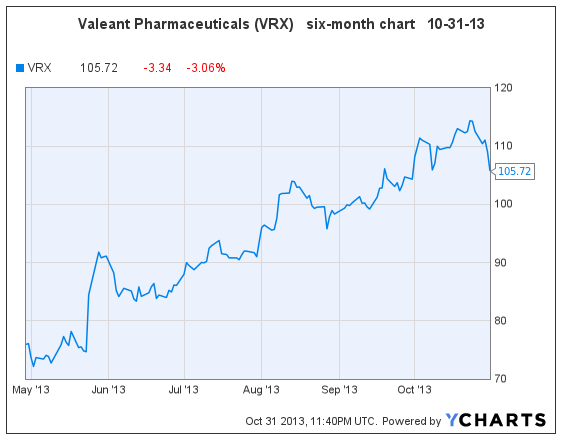

Valeant Pharmaceuticals Reports Third Quarter Earnings

Valeant Pharmaceuticals (VRX, $105.72) posted a quarterly net loss due to restructuring and impairment charges, but cash earnings per share (EPS) came in at $1.43 vs. consensus $1.41 and last year’s $1.15. Full year EPS remain on track to grow 36%.

Valeant recently acquired Bausch & Lomb, and today increased its expectations on cost-savings from the merger. Morgan Stanley remarked, “We were encouraged to learn that since VRX closed the acquisition on August 5, Bausch has delivered same store sales organic growth of 10% as compared to the prior year.”

S&P commented today, “We see VRX driving growth through its disciplined M&A business model.” Valeant continues to pursue small acquisitions for cash, and is open to a merger of equals as well.

On October 6 I said, “The stock broke out of another trading range on October 1, and could easily keep rising from here. We would accumulate additional shares under $108.” Investors then had a brief opportunity to buy under $108 before the recent run-up to a high of $115.06. Now that the stock has dipped below $108, I again urge aggressive growth investors to consider shares in Valeant Pharmaceuticals.

Here’s my research report from July 6.

Goodfellow LLC Rating: Accumulate, Aggressive Growth. (10/31/13)

* * * * *

Visa Fourth Quarter Disappoints; Outlook Remains Strong

Visa Inc. reported fourth quarter profit of $1.85, down from $2.47 a year ago, due to higher income taxes. Revenue was up 9%. Going forward, the company expects mid/high double-digit earnings growth and low double-digit revenue growth, despite continued pressure from a weak global economy and adverse foreign exchange conditions.

Visa also added $5 billion to its share repurchase program.

This morning, Reuters reported that six Wall Street firms raised their price targets on Visa shares, and one company lowered its price target.

I like Visa’s strong earnings growth, bullish chart, and lack of long-term debt; but dislike the high PE.

Visa shares appear in Best Stocks Now — October 27, 2013. Read my October 20 report on Visa Inc.

Goodfellow LLC Rating: Buy, Growth. (10-31-13)

* * * * *

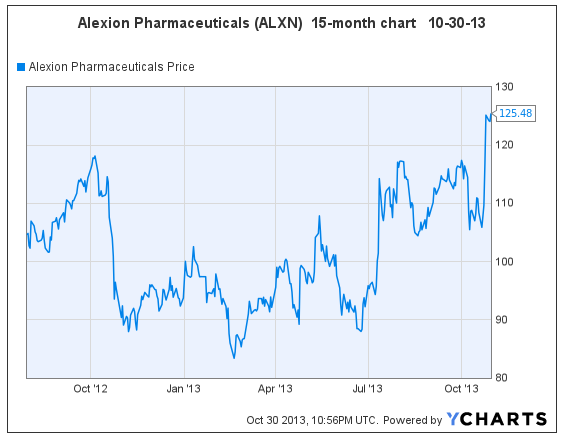

Alexion Pharmaceuticals’ (ALXN, $125.50) stock continues to rise since reporting third quarter earnings last week.

On October 24, I said, “The chart is looking more bullish now, and it’s possible that we could see the stock break past short-term resistance at $118 in the near future.” The stock broke through upside resistance the next day, and will likely continue to climb for a while. I would definitely buy more shares on any dip below $120.

On February 14, when Alexion shares were $86.60, I told Ransom Notes Radio listeners, “Aggressive growth investors and traders should buy now, below $90.” The price is up 45% since then.

Goodfellow LLC Rating: Accumulate, Aggressive Growth. (10-30-13)

* * * * *

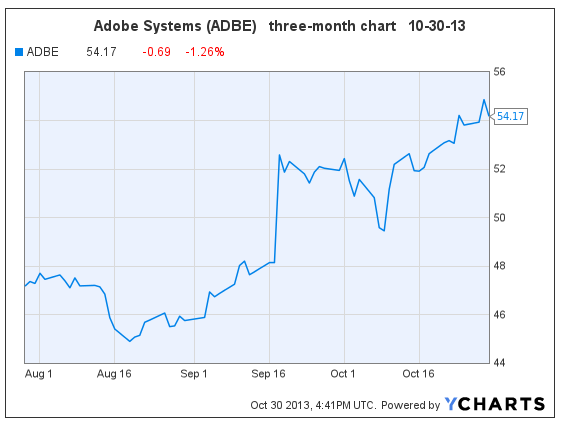

Adobe Stock Continues to Reach New Highs

(ADBE, $54.20, down $0.66 midday)

Software company Adobe Systems‘ stock continues to climb, reaching new highs again yesterday. On Sept. 18 I said, “The stock, which broke past resistance today, could briefly bounce below $50 again before climbing higher, but we really wouldn’t quibble over the purchase price at this point.” The share price then bounced below $50 on Oct. 8-10, broke through upside resistance on Oct. 21, and is now up 18.7% since I told investors to buy Adobe on June 27. (The S&P 500 is up 9.6% since that day.)

I still love Adobe stock, and would try to accumulate below $53.

Goodfellow LLC Rating: Accumulate, Aggressive Growth. (10/30/13)

* * * * *

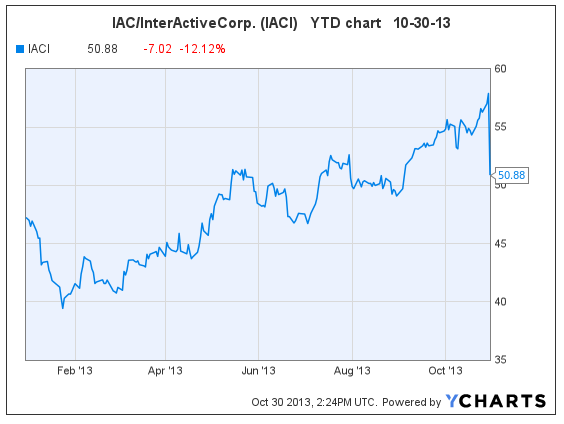

IAC/InterActive Stock Plunges on Weak Fourth Quarter Revenue Outlook

After reaching new highs yesterday, the stock of IAC/InterActiveCorp. fell 13% to $50/$51 today. A weak fourth quarter revenue outlook was the culprit. IAC/InterActive provides online services for internet companies which offer diversified consumer products and services, including Match.com.

Third quarter earnings per share came in at $1.13 after yesterday’s close, way above estimates of $0.77, and above $0.43 last year, but revenue up 5.9% was apparently lower than expected. Fourth quarter revenue is expected to be down vs. last year. Wall Street firms are tweaking price targets today.

With today’s price drop, the 2013 PE is 13.1 and the dividend yield is 1.9%.

From early July through early September, the stock traded between $49 – $53, then ran up to $58.06 yesterday. On Sept. 21, I said, “my inclination would be to only buy shares of IACI on the pullbacks. In this case, I would try to buy on a dip to $51.” With earnings growth still on track, I expect the stock to resume trading in the low $50’s prior to running up again.

Goodfellow LLC Rating: Accumulate, Aggressive Growth, Growth & Income, Value. (10-30-13)

* * * * *

The Goodyear Tire & Rubber Company (GT, $20.76) reported third quarter earnings per share (EPS) today, up 51% vs. last year, but missing analysts’ revenue and EPS estimates. The stock promptly fell 6%. Gross margins came in higher than expected. The company added that its full-year performance outlook remains unchanged.

On October 1 and October 21, I said, “While we see the stock as undervalued, we’d prefer that the stock stop climbing and establish a trading range before buying shares. We would use any market correction as an opportunity to buy more shares.” The stock price correction is now happening.

Goodfellow LLC rating: Accumulate, Growth. (10-29-13)

* * * * *

Scroll down to the last story on Edwards Lifesciences (EW) to read today’s share price update. (10-29-13)

* * * * *

Amgen Inc.: Change in 2014 Earnings Growth

(AMGN, $118.10, up $1.78 midday)

Earnings growth projections of biopharmaceutical-maker Amgen have slowed to 9% in 2014. The growth rate is no longer high enough to warrant a Goodfellow LLC buy-rating.

Scroll down to the last entry from October 5 to read my recent remarks on Amgen, when I added that the stock “appears ready to head back to recent highs of approximately $118.” The stock reached $118 today.

That being said, the stock price broke past upside resistance today. I absolutely expect it to rise from here; I believe that current shareholders should hold their shares and expect near-term capital gains.

Goodfellow LLC Rating: Hold, Growth & Income, Value, Public. (10-28-13)

* * * * *

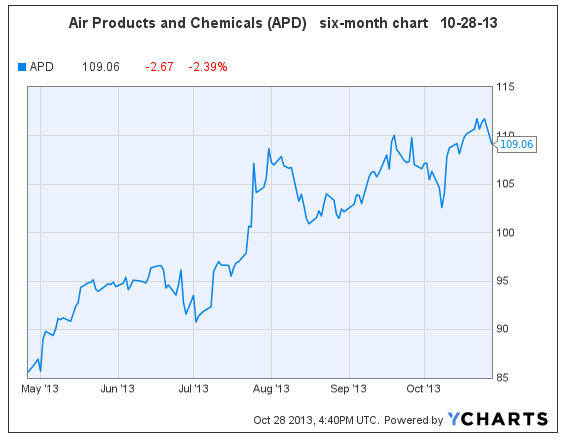

Air Products and Chemicals: A Change in Projected Earnings Growth

(APD, $111.73 at the close on Friday)

APD’s earnings growth projections have come way down since late September, to 2%, 10% and 11% over the next three years. The growth rate is no longer high enough to warrant a Goodfellow LLC buy-rating.

That being said, the stock price broke past upside resistance last week. I absolutely expect it to rise from here; I believe that current shareholders should hold their shares and expect near-term capital gains.

APD appears in September’s Best Stocks Now.

Goodfellow LLC Rating: Hold, Growth & Income, Public. (10-28-13)

* * * * *

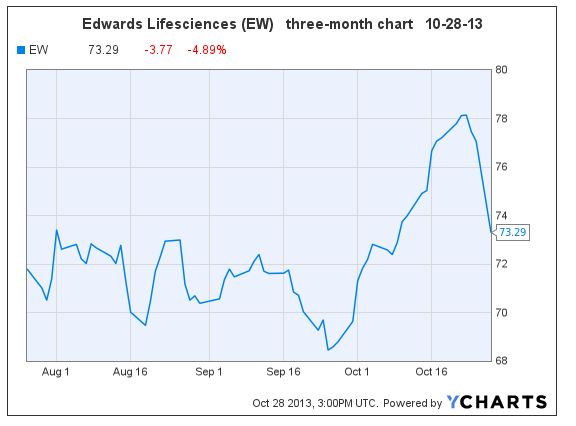

Edwards’ Price Drop Gives Shareholders Heart Attack

EW ($73.34, down $3.72 in early trading)

Edwards Lifesciences Corp., maker of artificial heart valves, reported third quarter earnings per share today of $0.68 vs. the consensus $0.66 and last year’s $0.58. It’s not uncommon for stocks to rise on anticipation of good earnings (or other good news) and then fall when the actual news comes out, especially with aggressive growth stocks. Buy now!

Read my report from October 9.

Goodfellow LLC rating: Strong Buy, Growth, Value. (10/28/13)

***Addendum 10/30/13***

The stock has fallen to June/July 2013 support levels, when it traded $65 – $72. Watch for it to hold support for a few days before jumping in under $67.

S&P remarked, “We see continued strength in transcatheter valve sales supported by expected approvals of more advanced valves, and mitral valve development progress. Headwinds we see include tough U.S. transcatheter valve stocking comps, higher interest costs and more competition, partly offset by share buybacks.”

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply