Featured Stocks in Action — week of October 7, 2013 (Oct. 10th update)

Posted by Crista Huff on Oct 10, 2013 in Buy Now!, Dividend Stocks, Famous Stocks, Free Stock Market Content, Growth Stocks | 0 comments

(Note: This article was reserved for Goodfellow LLC subscribers until January 28, 2017, when I made it available to the general public.)

Make sure to review this week’s Short-Term Trade Ideas,

and prior weeks’ Featured Stocks in Action.

There are sure to be good portfolio ideas there too!

Priceline.com (PCLN, $1015.49) shares are having a pullback. On Oct. 4, I said, “Priceline.com shares continue to reach new highs. Earnings growth estimates remain the same as our September commentary. Use stop-loss orders, and wait for a pullback to accumulate more shares.” Shares bounced yesterday at $972, and will likely bounce in that vicinity once more before recovering.

Goodfellow LLC Rating: Accumulate, Aggressive Growth, Value. (10/10/13)

* * * * *

United Technologies (UTX, $104.90) raised its dividend by 10% today, to $0.589 per quarter. The current yield is 2.2%.

On Oct. 1, I said “The share price reached new highs in September, and seems somewhat overvalued. We love the stock, and would be happy to buy shares once a new support level is established.” (Click here and scroll down to the last stock update.) Now that the market has had a pullback, I’d be comfortable jumping in anywhere below $104.

Read our longer report on UTX from Sept. 15.

Goodfellow LLC rating: Buy, Growth & Income. (10-10-13)

* * * * *

Morgan Stanley reported today on the annual Cerner Health Conference, attended by thousands of customers and partners. We just wrote about Cerner Corp. (CERN, $54.71) on October 4, but here’s an update from the conference.

Cerner is a leading healthcare information technology company. Standard & Poor’s Research says, “we believe more healthcare providers are choosing Cerner as an alternative to their existing vendors as healthcare technology requirements become more complex.”

RCM was the busiest area of the conference, as the industry is focused on controlling costs and increasing margins. Cerner also offered new systems to manage chronic disease; and to manage the amount of time that physicians spend on documentation.

Wall Street expects earnings to grow 18%, 17%, and 18% over the next three years. The PE is high at 39.

On March 4, I told Ransom Notes Radio listeners, “The stock has a very attractive chart pattern and appears immediately ready to rise.” It turns out that the stock broke out of a trading range that day, and has since risen 22% (vs. the S&P 500 +9.9%).

On August 5 I told Goodfellow LLC subscribers, “We would buy shares on the open market or risk losing a good buying opportunity.” The stock broke out in September, and is up 9% since our August report (vs. the S&P 500 -2.0%), and up 32% since I began recommending shares in January (vs. the S&P 500 +14.5%). (Note that the stock had a 2:1 split in July.)

The shares are still climbing. We would wait for a pullback below $52 to accumulate more shares.

Goodfellow LLC Rating: Accumulate, Aggressive Growth. (10/08/13)

* * * * *

“Gravity” Buoys Warner Bros. Revenue

Warner Bros. released “Gravity” this weekend, topping all competition with $55.6 million in North American ticket sales. “Gravity” is a 3D outer-space thriller starring Sandra Bullock and George Clooney. Warner Bros. is a division of Time Warner Inc. (TWX, $66.46).

Earnings at Time Warner are projected to grow 14% per year for the next three years. The dividend yield is 1.7%, and the PE is 18.

Time Inc. will spin off from Time Warner in first quarter 2014. Now that we’ve seen competitor News Corp. (NWSA) spin off 21st Century Fox (FOXA), which brought immediate profit to shareholders, I think Time Warner shareholders will be equally well-rewarded.

My history of price recommendations on Time Warner shares:

-

Shares are up 79% since I began recommending them here at Goodfellow LLC on March 3, 2012 at $37.14.

-

Shares are up 24% since I began recommending them at $53.52 on Ransom Notes Radio on February 15, 2013, while the S&P 500 is up 11.2% in the same time period.

-

On May 19, 2013, I said, “New investors should try to accumulate shares on a pullback. There’s no new support level yet, although $55/$56 is a fair assumption.” And that is exactly where it bounced one month later.

-

On September 11, 2013 I said, “The share price experienced an orderly correction within an uptrend during August, and could easily begin reaching new highs again near-term.” The shares then began reaching new highs on September 26.

The stock broke above resistance at $64.50 a couple weeks ago, and has only risen a little since then. I’d have no problem buying at the current price, but if I were waiting for it to dip a little, and didn’t mind therefore missing the stock altogether, I’d try to buy below $65.25.

Goodfellow LLC rating: Strong Buy, Growth, Growth & Income (10/07/13)

* * * * *

I am discontinuing my buy recommendation on Macy’s Inc. (M) due to the neutral/bearish chart. (10/06/13)

* * * * *

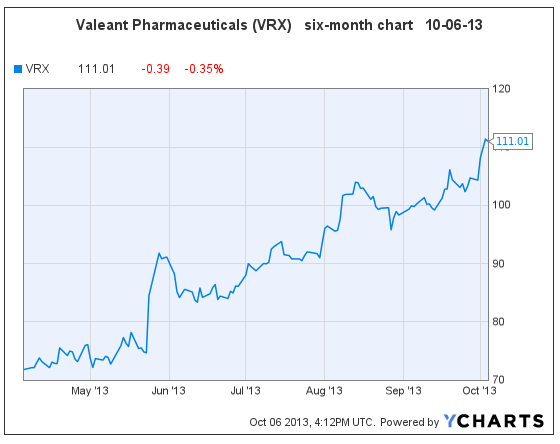

Valeant Pharmaceuticals’ (VRX, $111.01) stock continues to rise. Since our July update, Valeant’s earnings growth projections have increased to 36%, 40%, and 18% over the next three years. The PE is 18.

On January 21, 2013 I said, “I expect the VRX [$63.77 ] price to rise from here, possibly aggressively.” The share price is up 74% since that day. Most recently, on July 29, I said, “The stock [$91.41 ] appears to be ready to break out of a trading range in the near-term.” The stock began reaching new highs two days later, and is up 21% since that day.

The stock broke out of another trading range on October 1, and could easily keep rising from here. We would accumulate additional shares under $108.

We like Valeant shares due to aggressive earnings growth, low PE, and bullish chart; but dislike the company’s high debt levels. See our latest research report on VRX from July 6.

Goodfellow LLC Rating: Accumulate, Aggressive Growth. (10/06/13)

* * * * *

I am discontinuing the buy recommendation on Northern Trust Corp. (NTRS) until the earnings growth rate increases and the chart turns bullish. Investors should consider selling at resistance around $56, and investing in a stock with a more bullish near-term outlook.

Goodfellow LLC rating: Sell, Growth & Income. (10-06-13)

* * * * *

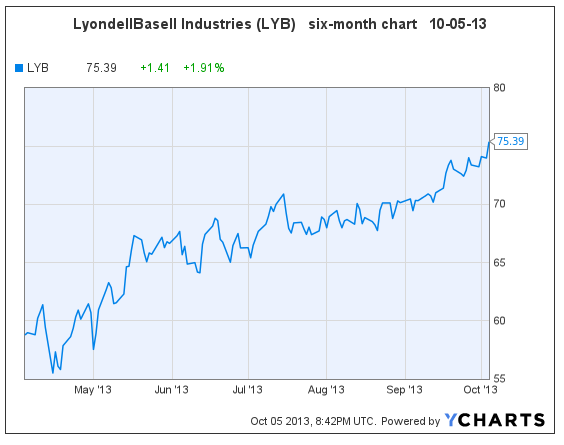

Shares of chemical company LyondellBasell Industries (LYB, $75.39) are up 16% since I began recommending them on June 7 at $64.87, saying, “The stock traded between $55 and $66 this year, and appears immediately ready to break out on the upside.” The stock just keeps rising steadily. I would consider buying shares on a pullback to $72. Read our report from August 25.

Goodfellow LLC Rating: Accumulate, Growth, Growth & Income, Value, Volatile. (10/05/13)

* * * * *

On September 10, I said that biopharmaceutical company Celgene’s (CELG, $157.27) stock “could pretty easily break out on the upside in the near-term.” The share price launched past resistance on September 27. It’s time to make a buying decision on Celgene.

Goodfellow LLC Rating: Strong Buy, Aggressive Growth. (10/04/13)

* * * * *

It’s time to re-visit the shares of biopharmaceutical-maker Amgen Inc. (AMGN, $112.91) for possible inclusion in portfolios.

Earnings are expected to grow 13%, 11%, 7% over the next three years. The PE is 15.4 and the dividend yield is 1.7%. Amgen announced in August that it will buy Onyx Pharmaceuticals in order to acquire its cancer drugs.

In September, we said to buy AMGN shares, right before the stock broke out of a trading range and began reaching new highs. The stock is now at a low point in a pullback, and appears ready to head back to recent highs of approximately $118. I would expect the price to continue climbing from there. Buy Amgen now!

Goodfellow LLC Rating: Buy, Growth & Income, Value. (10/05/13)

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply