DirecTV Agrees to AT&T Buyout Offer

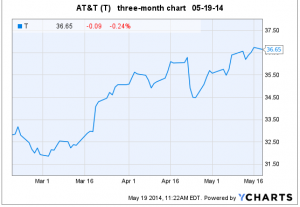

(T, $36.65, down $0.09 midday)

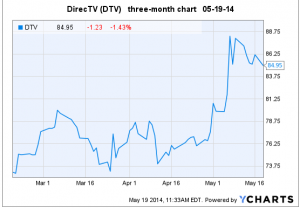

(DTV, $84.95, down $1.23 midday)

AT&T Inc. (T) has agreed to purchase DirecTV (DTV), the largest U.S. satellite-TV company, in a transaction worth $48.5 billion. DirecTV shareholders will receive $28.50 in cash and approximately $66.50 in AT&T stock for each DTV share, totaling about $95 per share. The deal is subject to regulatory approval, and will also be reviewed in a court of law, since a shareholder lawsuit has been promptly filed as well. Watch for a possible close of the transaction in mid-2015.

DIRECTV’s major roadblock had been its lack of access to broadband service, a problem which is solved by joining forces with AT&T.

Morgan Stanley is not wildly bullish on the merging of these two famous companies, saying “there is limited value creation from putting these two assets together, even though each may be a strong business individually.”

AT&T shares do not earn a buy rating at Goodfellow LLC because the company’s 3-year projected earnings growth rate is very slow at about 5% per year. However, DIRECTV’s 3-year projected earnings growth rate is about 16% per year, so that should help AT&T bolster future earnings growth and attract investors.

On the down side, DIRECTV does not merit a buy rating at Goodfellow LLC because of its very high long-term debt-to-capitalization ratio, which stood at 94.5% at year-end 2013. I prefer to keep that number below 40%, in order to minimize one more layer of risk associated with stock investing.

AT&T’s debt ratio was 41.9% at year-end 2013, and will presumably rise with the DirecTV buyout.

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

How to Proceed with DirecTV Shares

Sometimes a competing buyout offer arrives, driving the target company’s price higher. In this case, if a competing bid materialized, it would most likely come from DISH Network Corp. (DISH). DISH had a 2013 debt ratio of 86.1%, and would therefore be less financially able to pull off a DTV acquisition than AT&T. Proportionately, DISH has one-tenth the annual revenues that AT&T has.

All-in-all, my assessment is that a counter-offer by DISH is unlikely to take place.

All-in-all, my assessment is that a counter-offer by DISH is unlikely to take place.

On May 7, 2013, we told Ransom Notes Radio listeners and Townhall Finance readers that “Growth stock investors should make an immediate decision on whether to own shares in DIRECTV.” The stock has since risen 37.9%.

I last wrote about DTV on February 20, saying “DIRECTV’s stock chart is bullish. The stock broke out of a short-term trading range today, and is likely to continue climbing.” The stock price is up 13.4% since then.

DTV shares ran up as high as $89.44 this month on buyout speculation. Cautious investors should either take the money and run, or use a stop-loss order at $84.50 in case the acquisition fails to receive regulatory approval.

Enthusiastic investors should hold their shares and sell closer to the approximate buyout price of $95, while assessing their likelihood of making more money in other stocks henceforth, vs. holding their DTV shares.

How to Proceed with the AT&T Shares

AT&T shares have been trading sideways for two years, between $32-$39. The stock price has been on a recent uptrend, and could reach price resistance at $38/$39 again in the short-term. However, I do not expect much more from the stock this year, because there’s simply no earnings catalyst to attract investors.

AT&T shares have been trading sideways for two years, between $32-$39. The stock price has been on a recent uptrend, and could reach price resistance at $38/$39 again in the short-term. However, I do not expect much more from the stock this year, because there’s simply no earnings catalyst to attract investors.

Goodfellow LLC rating on AT&T: Hold, Public. (05-19-14)

Goodfellow LLC rating on DTV: Hold, Growth, Public. (05-19-14)

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply