The Latest TPP News — updated July 12, 2016

by Crista Huff

Discussions Ongoing to Fix TPP Data Localization Requirements

The financial services sector has been excluded from the TPP’s e-commerce chapter, which contains a ban on data localization requirements. As a result, financial companies could be required to store data on servers within TPP partner countries, a move which the companies say puts data security at risk. (Read more in “Pols Call For New TPP Data Rules For Banking Sector” — Law 360, 01-12-16)

The Obama administration is working to fix this problem in future trade agreements, such as TiSA; and with side letters with the four TPP partner countries which are not participating in TiSA. As of July 8, 2016, the House Ways & Means Committee has not endorsed the TPP, while it awaits resolution to both the data localization issue, and the conflict between the biologic patent exclusivity period allowed by U.S. law, vs. that offered within the TPP.

* * * * *

Sen. McCain Dupes Democrats into Changing U.S. Biologics Patent Law to Advance TPP Ratification

In a July 8 Inside U.S. Trade article that detailed the above-referenced data localization problem in the TPP, there was a relevant closing paragraph:

With the data fix on the way to being resolved, [USTR] Froman identified the biologics issue as “a very important outstanding issue.” Following a call between President Obama and [Senator]Hatch in June, sources have said USTR has recognized it cannot try to circumvent Hatch on this issue or try to wait him out.

I recently exposed Senator McCain’s plan to solve the biologics problem in the TPP by changing U.S. law in advance of the TPP ratification vote. There are many Congresspeople and Senators who are planning to vote “NO” on the TPP due to the biologics problem. If that objection is neutralized via Sen. McCain’s plan, then an unknown number of those elected officials could change their TPP stance from “NO” to “YES”. This is the most serious game change that’s happened with the TPP in 2016. I urge voters and Congresspeople to pay close attention to how this plays out.

Read more in my article: “How the PRICED Act Delivers TPP Ratification (the Bullet Point Version)“, Crista Huff, Goodfellow LLC, 07-11-16.

* * * * *

Obama Admin Prepares TPP For Lame Duck Vote

U.S. Trade Representative Michael Froman announced on June 20 that the Obama administration is drafting implementing legislation, in preparation for a TPP ratification vote during the lame duck session of Congress.

A TPP lame duck vote will not go over well with voters, who perceive the timing of a lame duck vote as an attempt to shove the deal through Congress without consequences for many of the outgoing Congresspeople, and for the President himself. It should be noted, though, that many Congresspeople are equally as outraged at the idea of being asked to vote on such serious legislation at the very end of the President’s term in the White House.

It has long been my belief that the vote will take place in 2016, because the TPP is President Obama’s legacy legislation — bigger and more far-reaching than Obamacare. I cannot imagine the President allowing a newly-elected president to “get credit” for accomplishing the passage of the TPP. Many Congressional staffers who I’ve met with in 2016 have considered it absurd that the TPP would be brought to a vote this year. We now have clear proof that the Obama administration intends to do that very thing.

* * * * *

Worldwide Anti-TPP Sentiment Grows

Various global trade experts and government representatives commented on the TPP at a June 15 event hosted by the Asia Society.

-

Peter Gray, former Ambassador of Australia to the World Trade Organization, spoke of “systemic trade concerns” that are greater than before.

-

Former Acting Deputy U.S. Trade Representative Wendy Cutler spoke of growing anti-trade sentiment among U.S. voters, saying “there’s something going on now that’s new and this country will have to deal with.”

-

Shotaro Oshima, Japan’s former permanent representative to the WTO, commented on voters’ growing anti-TPP sentiment, saying “I’ve never seen this before” and “it’s kind of scary.”

-

Curiously, Mari Elka Pangestu, formerly Indonesia’s Trade Minister, also used the word “scary” in describing the U.S. Congress’ potential “no” vote on the TPP.

-

Oshima and Gray said that the Japanese and Australian legislatures are expected to ratify the TPP this year.

-

Separately, Canadian TPP industry groups told Inside U.S. Trade that their government would not likely vote on TPP ratification until after the U.S. vote.

-

South Korea plans to dock on to the TPP as soon as it’s ratified by all participating countries. Its government has already completed an economic and legal analysis of the agreement, in preparation for accession.

-

Wang Yong, a member of the Chinese Ministry of Commerce Economic Diplomacy Expert Working Group, said that China is warming up to the idea of joining the TPP.

(Source: Inside U.S. Trade, June 16, 2016)

* * * * *

See my June 16 article: “Requisite Committee Hearings Proceed Prior to TPP Vote”.

* * * * *

Sen. Hatch Discusses TPP Biologic Problem with President Obama

Senate Finance Committee Chairman Orrin Hatch (R-UT) spoke with President Obama on June 15, regarding the biologic drug problem within the Trans-Pacific Partnership (TPP) trade agreement. It became clear to Sen. Hatch that the President has made no progress in resolving the issue.

The TPP offers five to eight years of patent exclusivity for new drugs, while the pharmaceutical industry is seeking at least twelve years of exclusivity.

U.S. Trade Representative Michael Froman is working toward attaining eight “real” years of data exclusivity for pharmaceuticals, but Sen. Hatch says that eight years is unacceptable.

As it stands, Sen. Hatch is not willing to support the TPP, and he does not foresee the U.S. Senate backing the trade agreement. “Hatch also made clear there are currently not enough votes in the Senate to pass TPP, the biggest reason being the biologics issue. He also noted that there are ‘eight or more’ senators unwilling to vote for the agreement because of the tobacco carveout from TPP’s investor-state dispute settlement provisions, and another 13-16 House members who will vote against the deal for the same reason,” reported Inside U.S. Trade on June 16 2016.

* * * * *

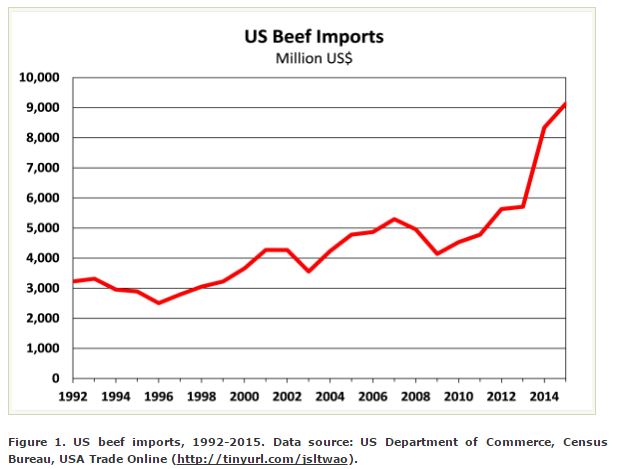

U.S. Beef Imports Surge After WTO Forces COOL Repeal

In 2014, the WTO ruled that U.S. country-of-origin labeling rules unfairly discriminate against meat imports and give the advantage to domestic meat products. How interesting it is to see the subsequent surge in U.S. meat imports on this chart:

Once again, trade agreements and global courts have undermined U.S. industry, and presumably, jobs.

* * * * *

Apparently Hillary Clinton was not finished deleting history…

“Paperback version of Clinton’s ‘Hard Choices’ omits her former TPP trade pact support” — Fox News, June 11, 2016

* * * * *

Obama Admin Blocks Release of Hillary Clinton TPP Emails

After agreeing to an open-records request to produce Hillary Clinton’s State Department emails on the Trans-Pacific Partnership (TPP) trade agreement, the Obama administration abruptly blocked their release until after the November 2016 general election.

We already know that POTUS-candidate Clinton is pro-TPP. Only the most willfully ignorant or woefully naive individuals could believe otherwise.

Curiosity begs the question: what’s in the emails? Perhaps there are sarcastic and disparaging remarks about voter groups that Clinton needs support from, in order to win her campaign. Maybe the situation is more nefarious. Perhaps there’s endless scheming for global governance, or against free market capitalism.

Time will tell. Eventually, we all pay the piper.

Read more here: “State Department Blocks Release Of Hillary Clinton-Era TPP Emails Until After The Election” — International Business Times, June 6, 2016

…and here: “45 times Secretary Clinton pushed the trade bill she now opposes” — CNN Politics, June 15, 2015

* * * * *

Wall Street Execs and U.S. Trade Rep Conspired to Promote ISDS in the TPP

Recent emails, obtained via a Freedom of Information Act request, portray the investment industry as being a driving force behind the Investor-State Dispute Settlement (ISDS) in the Trans-Pacific Partnership (TPP) trade agreement.

In reality, MANY industries are behind ISDS. As a matter of fact, the tobacco industry is furious that they’ve been carved out of ISDS within the TPP. Their dissatisfaction has contributed to the likelihood that the TPP ratification vote will fail in Congress.

A major problem with ISDS is that it allows businesses to use a global court as a bully pulpit, forcing TPP partner countries to roll back laws (environmental, financial, food safety, employment, etc.), thereby enabling businesses to more easily and cheaply accomplish their goals within those countries.

Disclaimer: In my stock market career, I am promoting Goldman Sachs Group’s (GS) stock. My ability to identify capital gain opportunities is a separate topic from my concern over the TPP. The only stock that I refuse to write about is Monsanto (MON); and that decision has been in force for many years.

Read more here: “Money Merry-Go-Round: Emails Show How Wall Street Execs and Alums Crafted Trade Bill” — Moyers & Company, June 1, 2016

* * * * *

G7 Leaders Say “Boo!” to China. China Yawns.

Leaders at last week’s G7 summit in Japan issued a communique expressing the need for a solution to the excess capacity problem in the global steel industry, hinting at possible litigation at the World Trade Organization. Attendees included President Obama and the leaders of Canada, France, Germany, Italy, Japan and the United Kingdom.

The biggest problem in the steel industry is that China is currently producing more than half of all global steel, at below-market prices, thus pushing competitors toward bankruptcy. Its industry is heavily-subsidized by government-sponsored entities, thereby allowing China to undercut its competitors on pricing.

One specific result is that U.S. steel production fell 27% in 2015. Obviously, an industry cannot sustain such large-scale revenue impact without widespread job layoffs, and personal & corporate bankruptcies.

The G7 leaders’ communique — which ironically does not mention China — carries no weight toward resolving steel overcapacity.

Three of the G7 countries in attendance — the U.S., Canada, and Japan — are partners in the not-yet-ratified Trans-Pacific Partnership (TPP) trade agreement. Clearly, these countries’ leaders realize that they need to appear willing to resolve international trade problems, in order to shore up waning U.S. support for the TPP. Thus, the milquetoast communique.

Additional diplomatic meetings that are scheduled to take place in China, in June and September, are also unlikely to produce satisfactory resolutions. China is exceedingly aware of the overcapacity problem, which they knowingly caused. As long as there are no harsh consequences for China’s behavior within the global manufacturing arena, China has zero motivation to change its game plan. (May 31, 2016)

“Hillary Email On China: ‘I Just Hope They Keep Buying Our Debt!’” — Breitbart, 05-17-16

DEMOCRATIC POTUS-CAMPAIGN TPP OPPOSITION

The Oregon Fair Trade Campaign released the results of a candidate questionnaire on May 6, 2016. Both Hillary Clinton and Sen. Bernie Sanders reiterated their opposition to a TPP vote during a lame-duck session of Congress.

Crista’s comments: I do not believe that Mrs. Clinton opposes the TPP. I believe that she changed her stance on the TPP, when it became apparent to her that being pro-TPP would not help her win voters during her POTUS candidacy. Read more here: “45 times Secretary Clinton pushed the trade bill she now opposes“ — CNN, June 2015.

TIMING OF THE TPP VOTE

In a May 1 interview with AgriPulse, Senate Majority Leader Mitch McConnell (R-KY) made it clear that Congress’ vote for TPP ratification will not take place prior to the November general elections, with little prospect for a subsequent lame-duck vote. McConnell cited problems with the political environment, due to POTUS candidates’ opposition to the TPP; and problems with tobacco and pharmaceutical provisions within the TPP.

“The political environment to pass a trade bill is worse than any time in the time I have been in the Senate,” he said. It’s worth noting that the TPP cannot enter into force without U.S. ratification.

President Obama continues to push for a 2016 TPP vote. (Source: Inside U.S. Trade, 05-05-16)

Crista’s comments: I think there’s a good chance that the President will sign implementing legislation for the TPP, which will trigger a 2016 ratification vote, regardless of timing issues. President Obama views the TPP is a key piece of his legacy. I can’t picture him handing the vote to the subsequent POTUS.

In addition, I believe the President lives in a state of delusion. He can easily convince himself that he will get his way on the TPP vote, especially since Congress has rolled over and allowed all kinds of destructive legislation to pass during President Obama’s tenure. He has no reason to believe that they will not roll over and vote YES on the TPP!

I think we will see the vote this year, and that the TPP will be voted down, to the horror of the partner countries, and the awe of the electorate.

JAPANESE TPP RATIFICATION & AG SUBSIDIES

The Japanese Diet — its legislature — plans to vote for TPP ratification during an extraordinary session in August. Earlier plans to vote on the TPP were delayed due to Japanese earthquakes in April. When the Japanese legislature addresses the TPP, it will, in tandem, consider a package of support programs for its farming and agriculture industries, including increased pork subsidies, to offset the negative effects of the TPP.

Let me make this clear: the biggest reason that the U.S. is involved in the TPP is to open up Japanese markets to U.S. crop and meat products. Japan does not want our crop and meat products, but they DO want access to U.S. markets. Therefore, Japan is planning to ratify the TPP while also increasing subsidies to their farm & ag industries, thereby making their products cheaper for Japanese citizens to consume than competing U.S. products.

CAN TPP PROBLEMS BE RESOLVED?

The TPP negotiation results did not meet the goals of the U.S. tobacco, financial services, and pharmaceutical industries.

Thus, news stories hint at prospects of resolving these concerns through a renegotiation of the trade agreement. Even this week, the U.S. Treasury Dept. plans to address problems stemming from a TPP requirement that financial services firms be subject to local data storage requirements. As the weeks and months pass, it becomes clear that resolutions to industry concerns are not forthcoming.

A long list of statesmen have made it abundantly clear that the TPP will not be renegotiated, including Canadian Prime Minister Justin Trudeau, Mexican Economy Secretary Ildefonso Guajardo, New Zealand Prime Minister John Key, Peruvian Minister for Foreign Trade and Tourism Magali Silva, and U.S. Treasury Secretary Jack Lew.

On April 29, in response to U.S. Congress’ concerns over the TPP’s market exclusivity period on biologics, Singapore Ambassador to the U.S. Ashok Kumar Mirpuri said that partner countries view negotiations as firmly concluded. (Source: Inside U.S. Trade, 05-05-16)

WHO’S WRITING THE RULES ON TRADE?

Eight former secretaries of defense wrote to Congress in late April, urging them to pass the TPP, using the worn out “the TPP will contain China” adage. Days later, President Obama wrote in The Washington Post, “The world has changed. The rules are changing with it. The United States, not countries like China, should write them. Let’s seize this opportunity, pass the Trans-Pacific Partnership and make sure America isn’t holding the bag, but holding the pen.”

News flash: China does not play by anybody’s rules, and China already OWNS the Asian economy.

China established the Asian Infrastructure Investment Bank (AIIB) in 2014. The AIIB is the world’s largest bank, including over $1 trillion in assets from 57 member countries. China also controls $11 trillion in private banking assets, through four Chinese banks that rank in the top ten of the world’s largest private banks.

Do you understand that China has already written the rules of international trade, and 56 countries abide by those rules, through membership in the AIIB, and through their willingness to deal with Chinese currency manipulation?

Additional reading: A Pacific Trade Deal Won’t Stop China’s Reckless Rise — Kevin Kearns, President, U.S. Business and Industry Council

* * * * *

Crista Huff is a stock market expert and a conservative political activist. She is the Chief Analyst at Cabot Undervalued Stocks Advisor; owner/operator of Goodfellow LLC, an outperforming stock market website; and she works with End Global Governance and issues groups to defeat the Trans-Pacific Partnership trade agreement. Send questions and comments to research@goodfellowllc.com.

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply