News. Corp.’s Separation of Publishing & Media Businesses

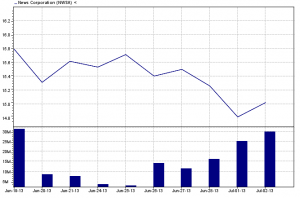

News Corp. separated its publishing and media/entertainment businesses after the market closed on June 28, 2013.

For every four shares of News Corp. (NWSA) common stock which shareholders previously owned, they will now own four shares of stock in the new media company (21st Century Fox, FOXA) and one share of stock in the publishing company (News Corp., NWSA):

-

-

One share of News Corp. (NWSA), which represents the publishing business. The publishing business plans to have $2.6 billion cash-on-hand, no debt, a $500 million repurchase program, and will pay dividends to shareholders.

-

-

Dow Jones & Co.

-

British and Australian newspapers

-

HarperCollins book publishing

-

Australian television

-

Four shares of 21st Century Fox (FOXA), which represents the media & entertainment business. These businesses generated approximately 90% of operating income in fiscal 2012. The company will concentrate on launching a national sports network called Fox Sports 1, which will compete with ESPN.

-

20th Century Fox film studio

-

Fox News cable channel

-

Fox broadcast network

Here’s the explanation from News Corp. on how to allocate the cost basis of former News Corp. shares to the separated companies of News Corp. and 21st Century Fox. Scroll down to the paragraph which overlaps the bottom of page one and the top of page two. It essentially says that an investor can allocate 88.55% of their cost basis to their FOXA shares and 11.45% of their cost basis to their NWSA shares. Or alternately, that the allocation percentages can by slightly different: 88.50% and 11.50%.

Make sure to save the cost basis explanation, and give it to your accountant after you sell any of the aforementioned shares, so that he/she can properly calculate your profit/loss when you file income taxes. It’s important: please do it now.

* * * * *

To sign up for our newsletter, send an email to research@goodfellowllc.com and ask for the free newsletter.

Questions? Contact Crista Huff at research@goodfellowllc.com.

* * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply