Cisco Enters Cloud Market the Day Before Google Slashes Cloud Prices

Yesterday, Reuters reported, “Cisco Systems Inc. (CSCO) plans to begin offering ‘cloud’ computing service to corporate customers, pledging to spend $1 billion over the next two years to enter a market now led by Amazon.com Inc. (AMZN).“

This afternoon, Google Inc. (GOOG) announced that it will slash its cloud computing prices up to 85% in order to steal market share from Amazon and Microsoft (MSFT).

I’m thinking that the Sales Director at Cisco Systems just lost his appetite for dinner.

“Cloud computing” refers to the practice of renting computers and data storage to companies and individuals, whereby the customers avoid expensive hardware investments.

Let’s get down to brass tacks and figure out what to do with these stocks.

As a refresher — and maybe as a surprise to some subscribers — I make all my stock decisions after spending approximately 60 seconds looking at numbers and charts. Yeah, it’s a “Rain Man” thing, but it works. And so I’m never going to agonize over daily news stories; I’m going to stay focused on the process that I’ve already developed, which very effectively identifies good growth stocks, and minimizes risk.

Subscribe now to read more about Goodfellow LLC’s buy-rated stocks.

AMAZON.COM INC. (AMZN, $354.71)

Internet retailer Amazon.com will likely follow suit with Google’s change in cloud pricing. Earnings per share (EPS) were projected to grow 225%, 120% and 102% in 2014 through 2016 (December year-end), prior to Google’s announcement. The 2014 PE is 185.

On July 29, 2013, I discussed Amazon’s ridiculously high PE. I told lucky shareholders to hold their shares, due to the bullish chart, and to use stop-loss orders.

AMZN shares reached all-time highs in January, then fell, and have recently traded in the $337-$379 range. If the stock falls tomorrow (March 26) on the Google news, I would expect it to find new support around $320-$324.

This is a tough call. We’re looking at a stock with strong future earnings growth, a neutral chart, a huge PE, and bad news today. If I’d owned the stock, I would have gotten stopped out on January 31, because I generally use stop-loss orders, especially after big price run-ups.

This is a tough call. We’re looking at a stock with strong future earnings growth, a neutral chart, a huge PE, and bad news today. If I’d owned the stock, I would have gotten stopped out on January 31, because I generally use stop-loss orders, especially after big price run-ups.

If I owned it today, and it falls through support tomorrow, I would sell. If it held support, I’d plan to sell on a rebound to $375.

Goodfellow LLC rating: Sell, Aggressive Growth, Public. (03-25-14)

View my stock portfolio results!

CISCO SYSTEMS INC. (CSCO, $22.34)

The excitement over communications equipment company Cisco System’s entry into cloud computing will be quickly offset by cloud price competition, and lack of growth in their current businesses. Cisco’s EPS are projected to fall 1.5% in 2014, followed by growth of 6% and 9% in 2015 & ’16 (July year-end). Full-year 2014 performance is expected to include decreases in gross & operating margins, and revenue. Demand is falling in emerging markets.

The stock’s 2014 PE is 11.2, and the dividend yield is 3.40%.

On October 3, 2013, I said to sell CSCO. The stock continued falling, and hasn’t recovered. Then after the fall, on Nov. 14, 2013, I told shareholders that they’d get another chance to sell on a rebound to $23 in the near-term. That opportunity arrived in mid-January.

On October 3, 2013, I said to sell CSCO. The stock continued falling, and hasn’t recovered. Then after the fall, on Nov. 14, 2013, I told shareholders that they’d get another chance to sell on a rebound to $23 in the near-term. That opportunity arrived in mid-January.

There’s still strong price support at $20, and resistance at $23 and $26. If somebody gave me these shares, I’d put in a sell limit order at $22.75, and be done with it.

Goodfellow LLC rating: Sell, Public. (03-25-14)

View my stock portfolio results!

GOOGLE INC. (GOOG, $1,158.72)

Google Inc. is the world’s largest technology company. Its aggressive price-slashing might bring in new customers, but it will be many months before resulting revenue growth affects earnings. EPS are expected to rise to 17%, 18% and 16% in 2014 through 2016 (December year-end). The 2014 PE is high at 22.5.

The stock is experiencing a small pullback, after reaching all-time highs in February. I wouldn’t buy shares here, because they’re somewhat overvalued, and the chart is recently neutral.

The stock is experiencing a small pullback, after reaching all-time highs in February. I wouldn’t buy shares here, because they’re somewhat overvalued, and the chart is recently neutral.

See my comments from January 14, with links to prior articles.

Goodfellow LLC Rating: Hold, Aggressive Growth. (03/25/14)

*Note from Crista Huff — I have owned Google shares for quite a few years.

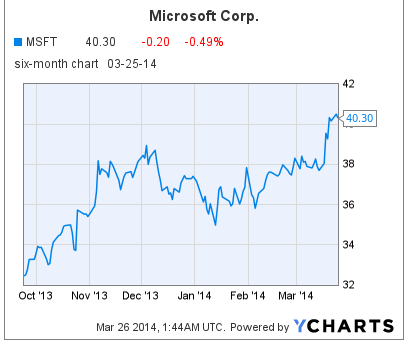

MICROSOFT CORP. (MSFT, $40.34)

I discussed Microsoft quite a bit on March 18. “Microsoft shares do not have a ‘buy’ rating at Goodfellow LLC because earnings per share (EPS) are projected to grow quite slowly: 2%, 7%, and 9% in 2014 through 2016 (June year-end). The 2014 PE is 14.6, in the middle of a six-year range of 9-19; and the dividend yield is 2.83%.”

“Microsoft shares broke through six-year price resistance in November, traded sideways for about four months, then broke out on the upside today with heavy volume. I expect the shares to continue rising immediately.”

“Microsoft shares broke through six-year price resistance in November, traded sideways for about four months, then broke out on the upside today with heavy volume. I expect the shares to continue rising immediately.”

“The stock is overvalued based on slow earnings growth and comparably high PE; but the chart is undeniably bullish. If I owned MSFT shares, I’d keep them, and use stop-loss orders to protect my downside.”

Goodfellow LLC Rating: Hold, Public. (03-25-14)

All eight 2013 & 2012 Goodfellow LLC stock portfolios

dramatically outperformed both the S&P 500 and the Dow!

View our outstanding 2013 and 2012 stock portfolio results.

* * * * *

Send questions and comments to research@GoodfellowLLC.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * *

Investment Disclaimer Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment.

Recommendations are based on hypothetical situations of what we would do, not advice on what you should do. Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed. The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities.

This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results.

Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

* * * *

Goodfellow LLC is a subscription-only stock market website. We strive to identify financially healthy companies in which traders and investors can buy shares and earn dividends and capital gains. See disclaimer for the risks associated with investing in the stock market. See your tax advisor for the tax consequences of investing. See your estate planning attorney to clarify beneficiary and inheritance issues associated with your assets.

Leave a Reply