What’s Next for the “Trump Bump”?

Posted by Crista Huff on May 23, 2017 in Free Stock Market Content, Growth Stocks, Politics | 0 comments

by Crista Huff

The phrase “Trump Bump” is a catchy media sound bite that implies that U.S. stocks have risen since November based on hopes that the new political administration and Congress will pass some sort of legislation that’s good for the economy. Congress might lower income tax rates, repeal portions of Dodd-Frank legislation, or authorize additional spending on infrastructure; each of which could spur job creation and economic growth.

If the rising stock market has been tied to potential action in Washington D.C., and the action doesn’t subsequently take place, then the implication is that the stock market will lose all the gains that it’s accrued since November.

I have never ascribed to the theory that new potential legislation is responsible for the recent rise in the U.S. stock market, and I’ve therefore tuned out the news media.

If any of those potential legislative changes take place, they will serve to increase analysts’ earnings estimates for public corporations. Rising earnings estimates certainly contribute to rising stock prices. However, the financial effects of potential legislation have not been built into most earnings estimates. I read Wall Street research reports every day. Time and again, the analysts clearly state that IF the new political administration takes legislative action, THEN the analysts will adjust their earnings estimates for the affected companies.

What’s so important about earnings estimates?

Professional investors — the people who run investment banks and mutual funds and pension funds and brokerage firms — make their stock market decisions using balance sheet numbers and ratios. Those numbers most definitely include consensus earnings estimates, which represent Wall Street’s expectation of how much profit companies will earn this year and next year.

While the news media caters to individual investors, exciting them or scaring them with phrases like “Trump Bump”, professional investors are behind the scenes, making decisions based on the successful (or failing) business endeavors of American corporations.

Professional investors recognize silly phrases like “Trump Bump” as media gimmicks. They have tried and true investment strategies that they stick with, which are generally unaffected by the fleeting preoccupations of popular culture.

So if stocks aren’t rising based on hopes and dreams, then why are stocks rising?

First of all, investors need to understand why stocks go up. Over the long term, stocks rise as corporate profits rise, because stocks represent ownership in corporations. A corporation becomes more valuable as it grows and makes more money, and therefore, each little piece of the corporation — as represented by shares of stock — will also grow and become more valuable.

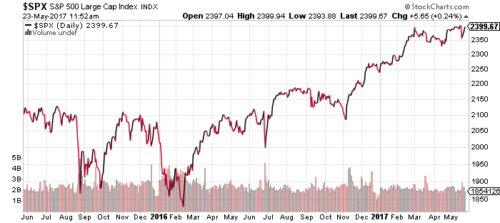

Of course, over the short term, virtually any news or event can jerk the stock market up or down. Prior to July of 2016, U.S. stock markets spent 19 months treading water, making no growth progress at all, while being periodically interrupted on the down side by Chinese currency devaluation (August 2015), falling oil prices (Jan.-Feb. 2016), and the Brexit vote (June 2016). (Please stare at those dates in the S&P 500 price chart, above, and you’ll see the dramatic effect that political and economic news can temporarily have on stock prices.)

By the time the November 2016 general election rolled around, U.S. stock markets were way overdue to rise, and had in fact begun their current up-cycle in July 2016. Yet throughout the prior stagnant time period in the stock market, corporate profits kept chugging along. I never had any trouble identifying excellent undervalued growth stock opportunities in those years. The only trouble I had was convincing investors that stocks would eventually rise again!

It’s been my belief that stocks have risen because corporate earnings growth is expected to be stronger-than-usual in 2017 and 2018 based on actual business endeavors that are taking place; not based on hopes and dreams related to potential Congressional action. Stocks are also not rising due to any particular sector “bubble” — another favorite term of the news media. A bubble refers to a buying frenzy that resembles irrational gambling activity, such as we saw with technology stocks in the late 1990’s, and the housing market in the late 2000’s. As I just made clear, there has been very little buying activity in the stock market for several years, so clearly, we’re not experiencing any sort of bubble therein.

The S&P 500 tends to rise 20% or more in two to four years of every decade. It’s only done that once in the current decade, in 2013. We’re due for a big year, and I expect 2017 to be a 20%+ year. What’s more, I also expect 2018 to be a better-than-average year. Here’s why: Savvy institutional investors have fueled the current stock market run-up; but most individual investors are still on the sidelines, sitting in cash, worrying about politics and interest rates and tax rates and The Wall and Russia and North Korea and you-name-it. Come December 2017, investors are going to see that the stock market rose quite a bit during the year, and they’ll be kicking themselves that they missed out on the capital gains. Then investors will buy stocks and stock mutual funds. Those purchases will be the fuel that pushes the stock market higher in 2018. Eventually, there’ll be a stock market correction, although I would not expect the correction to erase all the gains from 2017 and 2018.

Here’s a quick rule of thumb on how to know if you’ve missed the stock market run-up. The market has peaked when individual investors are “all in”. If you notice that friends, family, co-workers, and parents at your kid’s sports games are all talking about stocks, that’s when everybody’s invested and there’s no more money sitting on the sidelines that’s available to push the market up further. That’s when we’re going to have a stock market correction that will make headlines and scare investors. Investors will cash in, the market will fall, stocks will become undervalued again, and institutional investors will scoop up cheap stocks, thereby triggering a rebound in the market.

The cycle is predictable. Learn it, and use it to your advantage. Hint: if you always keep some cash on the sidelines, then you’re always ready to go on a stock market shopping spree during market corrections. That’s a great way to turn a potentially tense time period into an exciting bargain-grabbing opportunity!

In my estimation, nobody has missed their opportunity to make money in the current up-cycle in U.S. stock markets.

Happy investing!

Crista Huff

Chief Analyst

Cabot Undervalued Stocks Advisor

President, Chief Analyst

Goodfellow LLC

Please send questions and comments to research@goodfellowllc.com.

Investment Disclaimers

Leave a Reply