AVAGO TECHNOLOGIES: DEVELOP AN EXIT STRATEGY

(AVGO, $129.69, up $0.22 midday)

I last wrote about semiconductor manufacturer Avago Technologies Ltd. on February 26th, when the stock price shot up over 10%, due to the announcement of Avago’s then-pending acquisition of Emulex Corp. (The transaction was completed on May 5th.)

Let’s review the fundamentals & chart, now that the stock price has had a chance to settle into a new trading pattern.

Earnings outlook: 2015 earnings per share (EPS) are still expected to grow aggressively, at 72% (October year-end). Don’t get too excited, because 2016 & ’17 EPS growth is projected to slow to 7.9% and 3.8%. (These slow-growth numbers have been expected for a long-time, and therefore do not represent a surprise to professional investors.)

The 2015 price/earnings ratio (PE) is very low vs. the EPS growth rate, at about 15.4. At first glance, that indicates a drastic undervaluation in the stock price. However, the 2016 PE is 14.3, which is much higher than next year’s EPS growth rate. Investors should be aware that professional investors — who move the stock market with their large transactions — are not going to like Avago’s 2016 & ’17 stock valuations.

AVGO has a dividend yield of 1.17%; and the 2014 long-term debt-to-capitalization ratio is high at 62%.

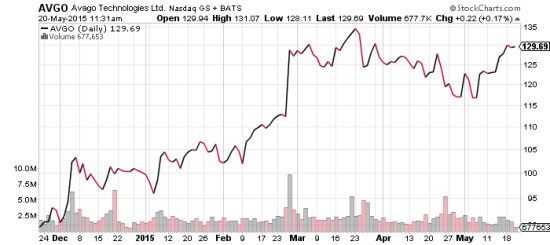

Technical chart: The stock has been trading between $114 – $136 since late February. It reached a new high of $136.28 on March 23rd.

Sign up to receive my free stock-investing newsletter! —->>

Recent recommendations:

-

The stock price rose as much as 28.7% after January 13th, when I said, “Current shareholders should expect additional capital gains. Momentum investors should jump in now…”

-

Then on February 26th, I encouraged buy-and-hold shareholders to continue to hold their shares.

Current recommendation:

-

Buy-and-hold investors who want to minimize downside risk should develop an exit strategy; then reinvest their capital into an undervalued growth stock. (Have some good stocks picked out in advance. The entire point of using stop-loss orders is to re-deploy the cash into better growth opportunities; not to sit in cash and watch to see if AVGO’s price rebounds.)

-

Momentum investors who bought AVGO based upon my January 13th trading recommendation should use stop-loss orders, no lower than $121.

AVGO shares do not qualify for a Goodfellow LLC buy rating due to slow 2016 & ’17 EPS growth, comparatively high 2016 & ’17 PE’s, and a high debt ratio. It is true that the chart might be signalling a near-term upside breakout. However, a stock without strong underlying fundamentals is not an investment: it is a gamble. Under no circumstances would I purchase AVGO shares right now.

Goodfellow LLC Rating: Develop an Exit Strategy, Public. (05-20-15)

Avago Technologies purchased Emulex Corp. (ELX) on May 5, 2015; and also purchased LSI Corp. (LSI) in 2014. AVGO was added to the S&P 500 index on May 7, 2014.

Chart courtesy of StockCharts.com.

* * * * *

Goodfellow LLC is a subscription-based stock market website. Stock portfolio investors pay an annual fee to read my articles, which help them profitably navigate the U.S. stock markets, with the goal of outperforming the U.S. stock market indices.

I use a combination of strict fundamental and technical criteria to choose the stocks that receive buy ratings from Goodfellow LLC. Each facet of my investment criteria serves to lower the risk associated with stock investing. My investment strategy works — year in and year out.

Eight of the ten 2012-2014 Goodfellow LLC model portfolios

outperformed the market averages by margins of 50-100% and more!

Subscribe now, and begin improving your investment portfolio returns today!

Send questions and comments to research@goodfellowllc.com.

Happy investing!

Crista Huff

President

Goodfellow LLC

* * * * *

Investment Disclaimer

Release of Liability: Through use of this website viewing or using you agree to hold www.GoodfellowLLC.com and its employees harmless and to completely release www.GoodfellowLLC.com and its employees from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

Goodfellow LLC and its employees are not paid by third parties to promote nor disparage any investment. Recommendations are based on hypothetical situations of what we would do, not advice on what you should do.

Neither Goodfellow LLC nor its employees are licensed investment advisors, tax advisors, nor attorneys. Consult with a licensed investment advisor and a tax advisor to determine the suitability of any investment.

The information provided herein is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. When information is provided herein from third parties — such as financial news outlets, financial websites, investment firms, or any other source of financial information – the reliability or completeness of such financial information cannot be guaranteed.

The information contained on this website is provided for informational purposes only and contains no investment advice or recommendations to buy or sell any specific securities. This is not an offer or solicitation for any particular trading strategy, or confirmation of any transaction. Statements made on the website are based on the authors’ opinions and based on information available at the time this page was published. The creators are not liable for any errors, omissions or misstatements. Any performance data quoted represents past performance and past performance is not a guarantee of future results. Investments always have a degree of risk, including the potential risk of the loss of the investor’s entire principal. There is no guarantee against any loss.

Leave a Reply